FAYETTEVILLE, Ga. — A new audit of Georgia’s film tax credit says the state has tightened some of its accountability – but is still exaggerating the industry’s impact on jobs and the economy.

The study was conducted by the state department of audits. The state department of economic development administers and cheerleads for Georgia's tax-subsidized film industry.

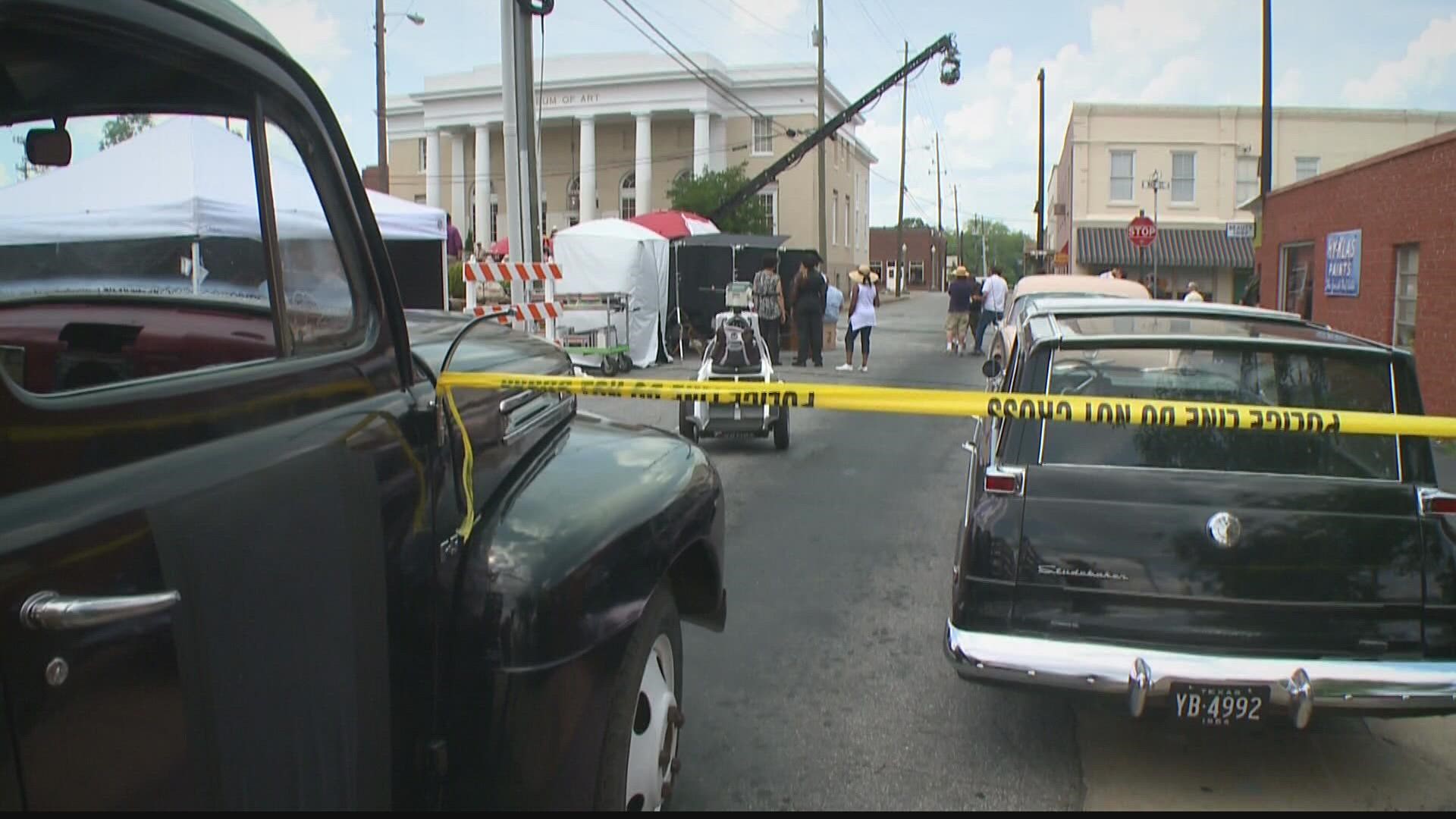

Georgia’s film industry created a sprawling development in Fayette County – but it wouldn’t have happened without huge subsidies from state taxpayers.

"The infrastructure has been building here for years because of that tax credit," said John Biord, a Tennessee-rooted filmmaker who has acquired a home in Fayette County to advance his career.

Alongside the sound stages at Trilith and other studios, workers are moving earth to build even more facilities for a filmmaking community that has planted roots in Fayette County.

"It’s a win-win situation both for the state, the people of the state, and the filmmaking community. A symbiotic relationship," Biord said.

But state auditors wrote a scathing report on the film tax credit two years ago, chiding boosters for exaggerating the economic impact and the number of jobs it created.

This week, they said much has improved – but that the state is still:

- Exaggerating the number of film jobs in Georgia;

- Giving tax incentives that still benefit out-of-state workers;

- Using a film tax credit with no monetary cap, unlike similar credits in New York and California;

- Not disclosing which companies are benefiting from the state’s tax credit and by how much, unlike states like North Carolina.

"This is a net loser for Georgia taxpayers. All the data says so," said Dr. JC Bradbury, a Kennesaw State economist who has studied film tax subsidies and has been critical of Georgia's. "The big winners are the film industry and no one else."

Yet in Fayette County, boosters argue that the subsidy has helped build a hometown industry that wouldn't have grown without it.

"A lot of people are moving here from LA because of our tax credits. And it’s kind of a win-win for everybody," said Melissa Hill, a film location coordinator in Fayette County.

Bradbury marvels at the film tax credit's almost unquestioned popularity at the state capitol among both political parties. The industry "builds a lot of positive vibes. The costs are very hidden and I think that explains a lot of its political success," Bradbury said.

Earlier this year, the state Senate briefly considered capping the state’s film tax credit. Within a day, senators withdrew it because the credit – and the film industry – has so much political support in Georgia.