ATLANTA — More than 18,000 businesses in Georgia were approved for COVID-19 relief loans of $150,000 or more through the Paycheck Protection Program, but in metro Atlanta this funding was concentrated in wealthier ZIP codes.

The lending pattern is part of a "deficit of support" that disproportionately affects Black business owners, according to an Emory University professor.

The PPP loans, created through the CARES Act and managed by the U.S. Small Business Administration (SBA), were intended to provide financial support to small businesses with 500 employees or fewer that were negatively affected by the economic crisis created by the pandemic.

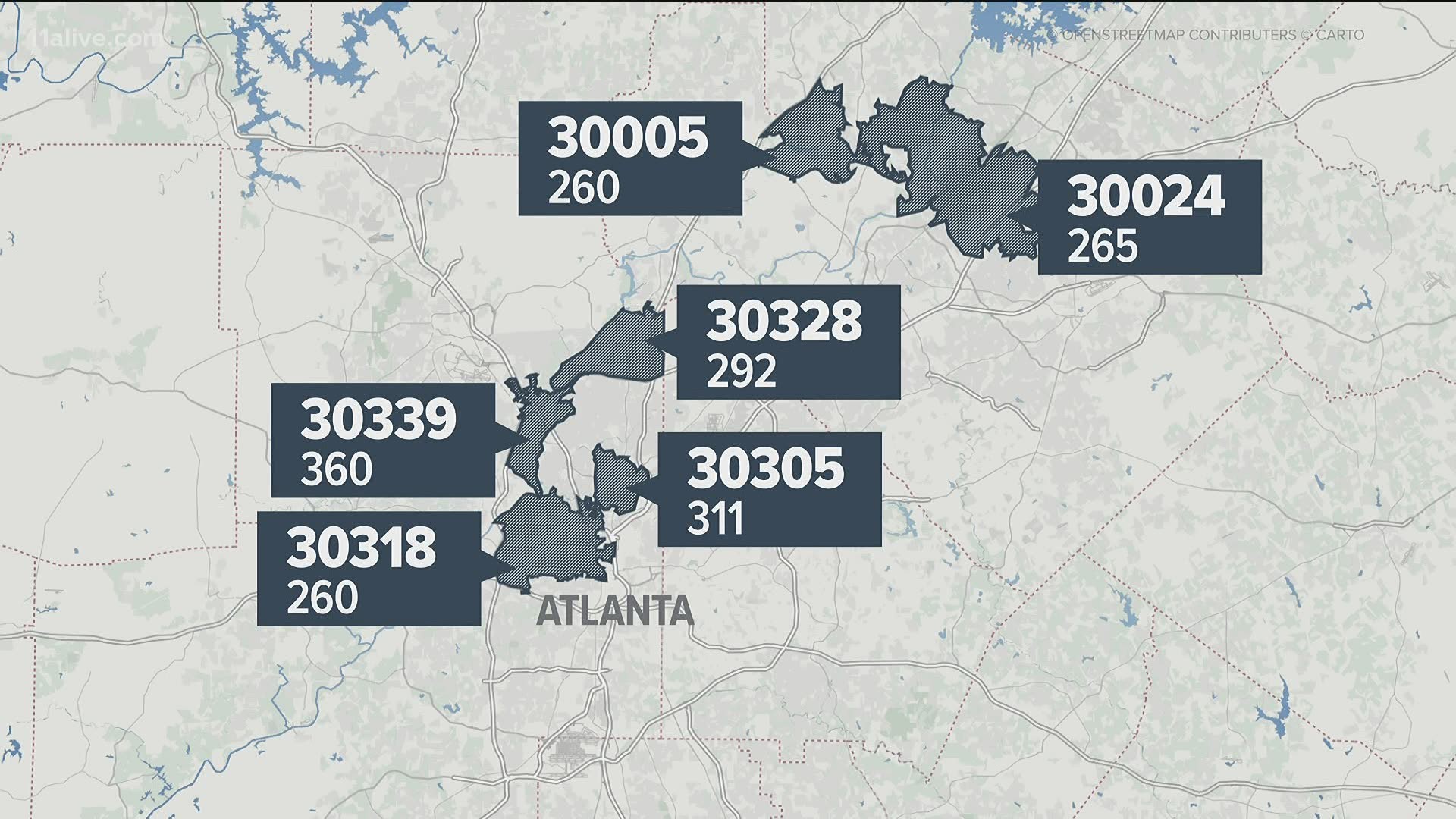

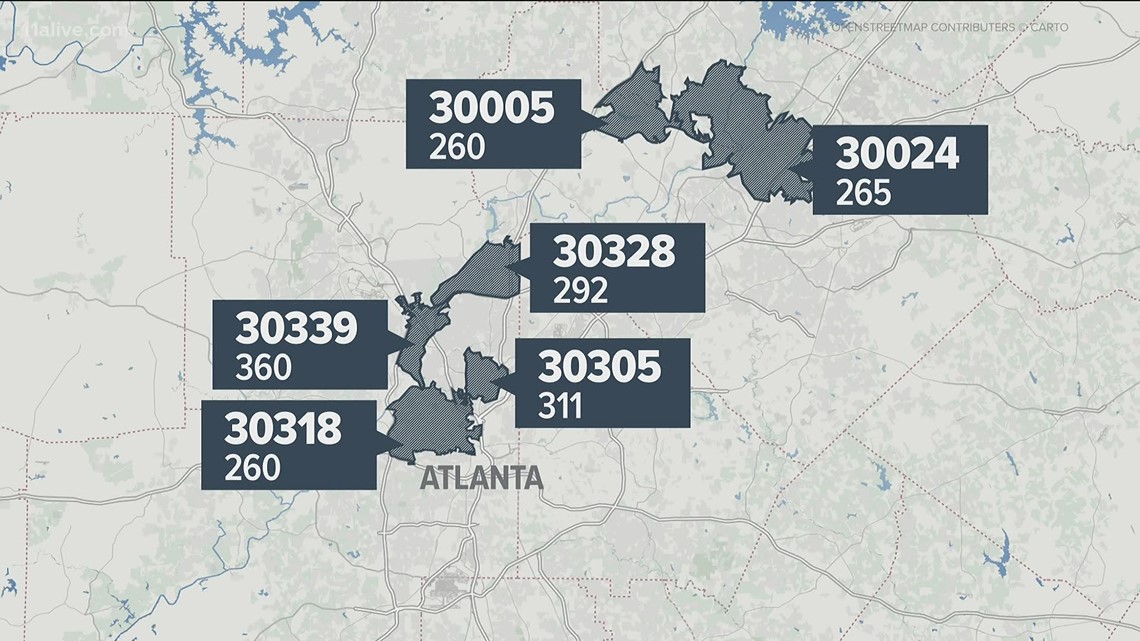

The Atlanta ZIP code with the most approved PPP loans was 30339, near Vinings in Cobb and Fulton counties, with 360 loans. Nearly 25% of loans approved in this area were for more than $1 million, compared to about 13% of loans greater than that amount in the entire metro area.

Of the 10 ZIP codes approved for the greatest number of PPP loans, six are among the wealthiest in Atlanta based on wealth index, according to Atlanta Business Chronicle research. Here's a snapshot of the next top six ZIP codes:

- 30305, near Buckhead in Fulton County: 311 approved loans;

- 30328, near Sandy Springs in Fulton County: 292 approved loans;

- 30024, near Suwanee in Gwinnett County: 265 approved loans

- 30005, near Alpharetta in Fulton County, and 30318 near West Atlanta in Fulton County: 260 approved loans.

According to Peter Roberts, the Emory Professor who has studied small businesses for years, including lending patterns, says it is a deeply-rooted structural problem that goes beyond PPP loans.

"The pattern that you see through the PPP period is exactly the same pattern that you see through 2010 through 2017. So the idea you have the post-previous meltdown, you have this fairly dramatic two-ish-to-one disparity that's replicated with the PPP," he said. "So it's probably something that's longer and deeper than just what happened during this program."

Finish reading the report on the Atlanta Business Chronicle.