ATLANTA — Over 100,000 Georgians will get lucky in TurboTax's multistate settlement, according to Georgia's Attorney General Chris Carr.

Officials said that they believe some Georgians were tricked into paying for free tax services by Intuit, TurboTax's owner.

“Georgia will continue to hold accountable any business that seeks to exploit financially vulnerable consumers,” Carr said.

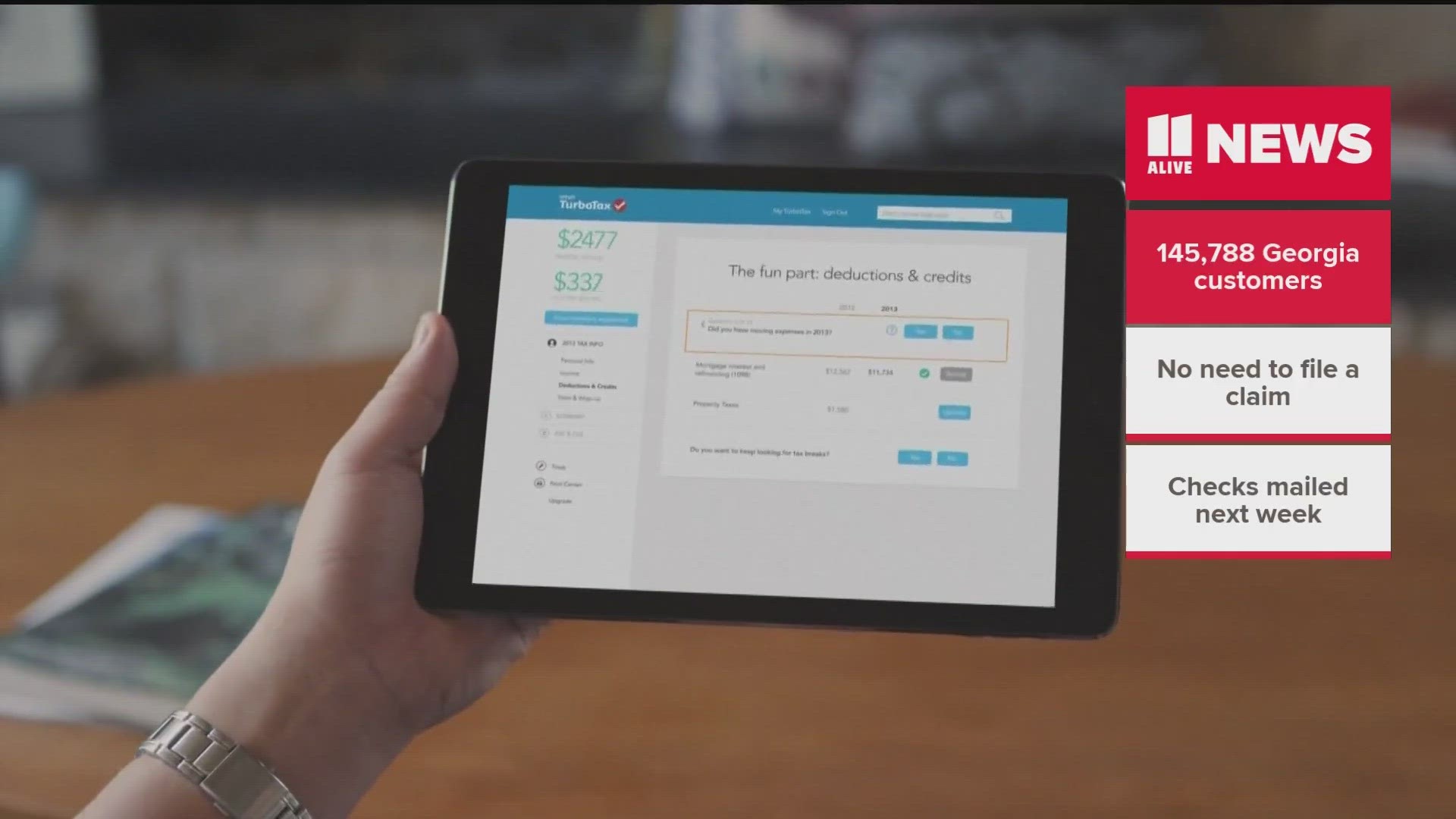

The Attorney General's office added that those who are eligible will be contacted via email about receiving their payment. They said they will not need to file a claim to receive their checks.

Checks will be mailed to those affected next week.

Who's eligible for a check?

Authorities said that those who are eligible are consumers who paid to file tax returns in the tax year of 2016, 2017 and 2018. But, they qualified for the IRS Free File Program.

How much will the Georgia consumers receive?

Georgians will get around $29 and $30 as a payment from the settlement. The office said the amount each consumer will receive is based on the tax years they filed.

Why is the settlement happening?

Last year, Carr announced a $141 million multistate agreement with Intuit. The settlement agreement cited that the company deceived millions of low-income Americans into paying for tax services.

Carr's office said those services should have been free through a federal program.

All 50 states and the District of Columbia have signed onto the agreement.

Carr said that Georgia will receive about $4.4 million for consumers that were affected.

“Thanks to the dedicated efforts of our Consumer Protection Division, more than $4.4 million in restitution will now be rightfully returned to the thousands of hardworking Georgians who were purposefully misled by TurboTax," Carr said.

For more information about the settlement fund and who is covered, visit here.