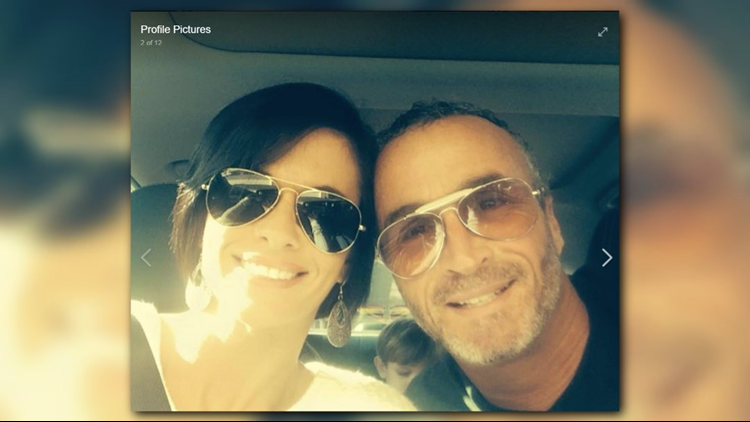

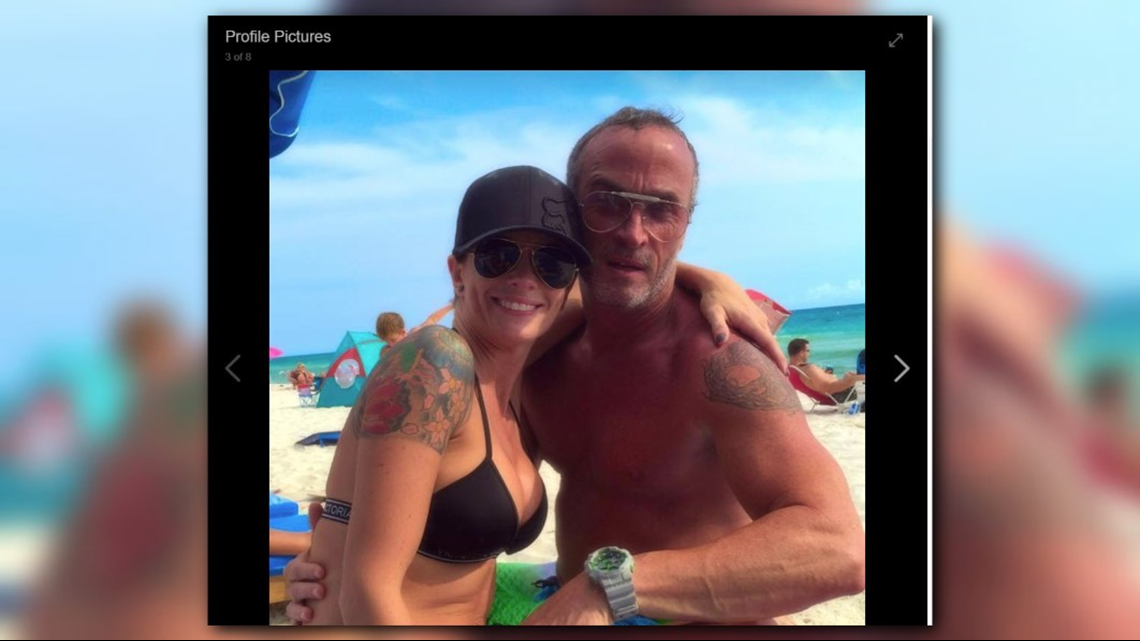

LAGRANGE, Ga. – The Livingstons have a picture-perfect family of five on Facebook—but the couple smiling in the photos with their three children have a secret, and it’s a secret that authorities said, have ripped off thousands of dollars in fraudulent insurance policies.

Independent insurance agent Amy Livingston, 34, and her husband, 48-year-old Matthew, were arrested Wednesday morning for exploitation and fraud scheme. A scheme that, Troup County’s Insurance and Fire Safety commissioner Ralph Hudgens’ said, likely reeled in more than $100,000.

Matthew, a former insurance agent himself, posted to his Facebook page: 0% LUCK. 100% HUSTLE.

It’s this alleged hustle, however, that landed him and his wife in jail, thanks to a consumer tip.

During a six-month investigation by the commission’s fraud division, the LaGrange, Ga., couple allegedly found that Amy was using the identities of Matthew’s former clients to create applications for fake life insurance policies.

According to Hudgens, those fraudulent applications collected $11,453 in advanced first-year commission payments through four different insurance companies. But, Hudgens said that he believes the duo has racked up more than $100,000 in their scheme.

“My fraud investigators discovered that the couple worked together to illegally obtain approximately $11,453 in commission fees by issuing fraudulent documents to insurance companies,” Hudgens said. “With additional evidence still coming in, we expect the amount stolen to increase to well over $100,000.”

This type of fraudulent activity is known as “churning.”

“[Churning is] taking insurance policies, existing policies, canceling them and then re-writing new policies so they could get an insurance commission off writing the new policies… converting these policies for their own personal use without the people that were being covered without their knowledge,” Hudgens said.

The Livingstons are accused of churning life insurance policies of their elderly clients—at least seven so far, but there could be more victims. Those clients who have had fake policies created in their name, may have further insurance issues down the road.

“Unfortunately, they are elderly and they're going to have a hard time getting new policies, maybe their health situation has declined and they are not eligible to get coverage again,” Hudgens said.

His agency, he said, is going to the insurance companies, asking them to restore the policy holders’ previous policies.

“Otherwise, what do they do? It puts these people, the victims, in a very, very precarious position, because they don't know whether they're going to have coverage if something happens… This is really a tragedy,” Hudgens said.

Troup County Sheriff’s deputies arrested the couple Wednesday morning at 9 a.m., in their driveway and took them to the Troup County Jail.

Amy was charged with seven counts of insurance fraud, five counts of exploitation of the elder, 12 counts of forgery and seven counts of identity fraud. Matthew was charged with three counts of insurance fraud and two counts of exploitation of an elder.

Amy, who has been licensed as a life and health insurance agent since 2010, faces possible suspension or revocation of her license. Matthew, however, has not been a licensed insurance agent since November 2016.

If found guilty, insurance fraud is a felony and the couple could face two to 10 years and a fine up to $10,000.

The investigation is ongoing. The couple remains in the jail. No bond has been set.

If you suspect an insurance fraud or if you were one of the Livingstons’ clients, call to verify your coverage with the insurance company listed on the policy, or contact Hudgens’ Consumer Services Division at (800) 656-2298.