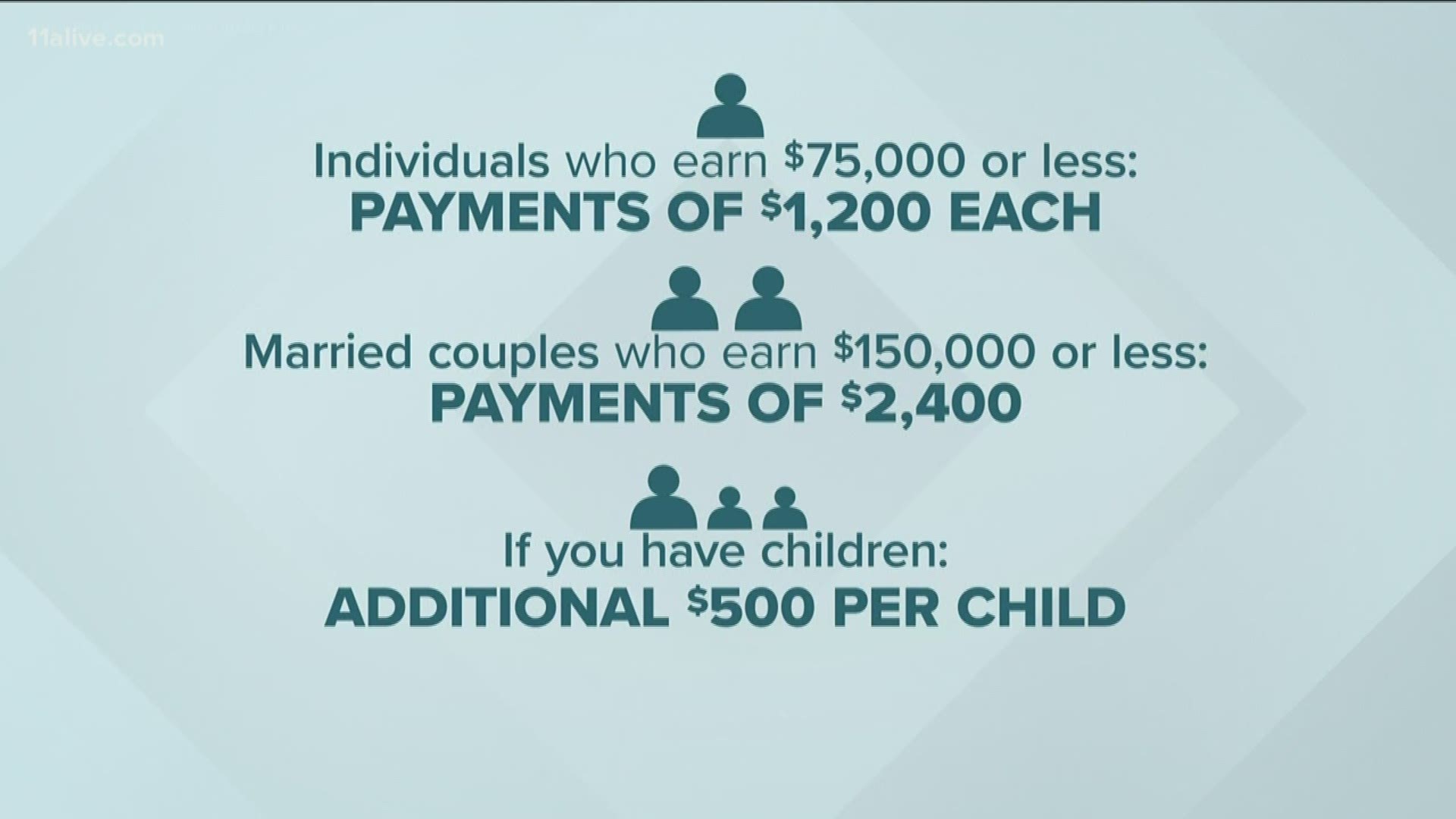

ATLANTA — After some confusion caused by IRS guidance issued earlier this week on the $1,200 stimulus payments expected to go to most Americans, the Treasury Department clarified one thorny part of the issue on Wednesday.

The IRS had said, "some seniors and others who typically do not file returns will need to submit a simple tax return to receive the stimulus payment," in a "Need to Know" explainer on the agency's website.

This appeared to contradict the language of the CARES Act law, which directed the IRS to use Social Security information to send payments "if the individual has not filed a tax return for such individual’s first taxable year beginning in 2018."

Seniors and others on Social Security

In a statement, Treasury Secretary Steven Mnuchin provided some clarity there: “Social Security recipients who are not typically required to file a tax return do not to need take an action, and will receive their payment directly to their bank account."

The department release added: "The IRS will use the information on the Form SSA-1099 and Form RRB-1099 to generate $1,200 Economic Impact Payments to Social Security recipients who did not file tax returns in 2018 or 2019. Recipients will receive these payments as a direct deposit or by paper check, just as they would normally receive their benefits."

That clears it up: If you're a senior or someone else who receives Social Security benefits, your stimulus payment will come to you the same way your benefits currently do. Nothing to worry about or take action on.

Tax filers, direct deposit and paper checks

As for people who have filed their taxes, the IRS guidance notes their payments will also automatically be generated based on tax return information from 2019 (or 2018, if you haven't yet filed for 2019).

If you haven't set up direct deposit before with the IRS, the agency says, "In the coming weeks, Treasury plans to develop a web-based portal for individuals to provide their banking information to the IRS online, so that individuals can receive payments immediately as opposed to checks in the mail."

it doesn't directly address what happens if you don't set up direct deposit, but given that Secretary Mnuchin's statement references paper checks and the IRS guidance acknowledges "checks in the mail," it's safe to assume that will be the fallback option. Just expect it to take longer - likely, a number of months longer - than an electronic payment.

Everyone else

We can now be reasonably confident the matter should be clear for Social Security benefit recipients and people who have filed taxes at least for 2018.

But what if you don't fall into either group?

People experiencing homelessness, young people who don't make much money or anyone else who otherwise simply doesn't usually file their taxes aren't really addressed.

The language makes clear, though, that everyone with legal status in the U.S. and who isn't claimed as a dependent on someone else's return is an "eligible individual" and therefore entitled to the payment.

So how can you make sure you get it?

It's possible in the weeks ahead, the government will try and use other information or means to direct the payment to you - for instance, if you get SNAP benefits on an EBT card, they could potentially send the money there.

But it's important to know they have not said anything about doing something like that, as of now.

Right now, there is only one way to guarantee you get the money you're entitled to - file taxes for 2018 or 2019. (11Alive has reached out to the Treasury Department to see if there will be any program or mechanism to help the people get their payment if they don't fall into the two addressed groups.)

"The IRS urges anyone with a tax filing obligation who has not yet filed a tax return for 2018 or 2019 to file as soon as they can to receive an economic impact payment. Taxpayers should include direct deposit banking information on the return," the IRS says.

That raises two obvious questions: What's the easiest, quickest way to file a tax return, and what if you don't have a bank account?

To the first question, one option for younger, more tech-savvy people who simply haven't filed taxes, you can go through the IRS free filing website or, if that's a bit confusing to wade through, use services like Turbo Tax which has a free option available until Saturday. Google "free tax filing" and see what works for you.

For those experiencing homelessness or in other low-income households, you can seek out help through what are known as VITA (Volunteer Income Tax Assistance) programs.

There are a number in Atlanta you can try to contact:

- Ebenezer Baptist Church/MLK Sr. Community Resources Collective: email information@mlksrcollaborative.org & phone 404-460-8321

- Emmaus House/The Center for Working Families: email info@emmaushouse.org & phone 404-523-2856

- Saint Philip AME Church: email info@saintphilip.org & phone 404-371-0749

11Alive has also been in touch with a tax expert, Dr. Steve Balsam at Temple University, who runs a VITA program through the school: You can contact his program at vita@temple.edu.

If you don't have a bank account for direct deposit or an address for a check to be mailed to, it may be possible to work with these organizations to establish a location for a point of delivery.

11Alive is focusing our news coverage on the facts and not the fear around the virus. We want to keep you informed about the latest developments while ensuring that we deliver confirmed, factual information.

We will track the most important coronavirus elements relating to Georgia on this page. Refresh often for new information.

MORE CORONAVIRUS HEADLINES