HOUSTON — There's a huge focus on the stimulus checks going to millions of Americans, but can we talk about the billions of dollars set aside for small businesses?

The package includes a $350 billion forgivable loan program intended to save jobs. It's called the Paycheck Protection Program.

Any business with fewer than 500 employees can apply. There's a formula that dictates how much they would get. If the business spent that money on employees, a mortgage, rent or utilities, the principal of the loan would be forgiven.

The loans are backed by the Small Business Administration but you can apply through your bank.

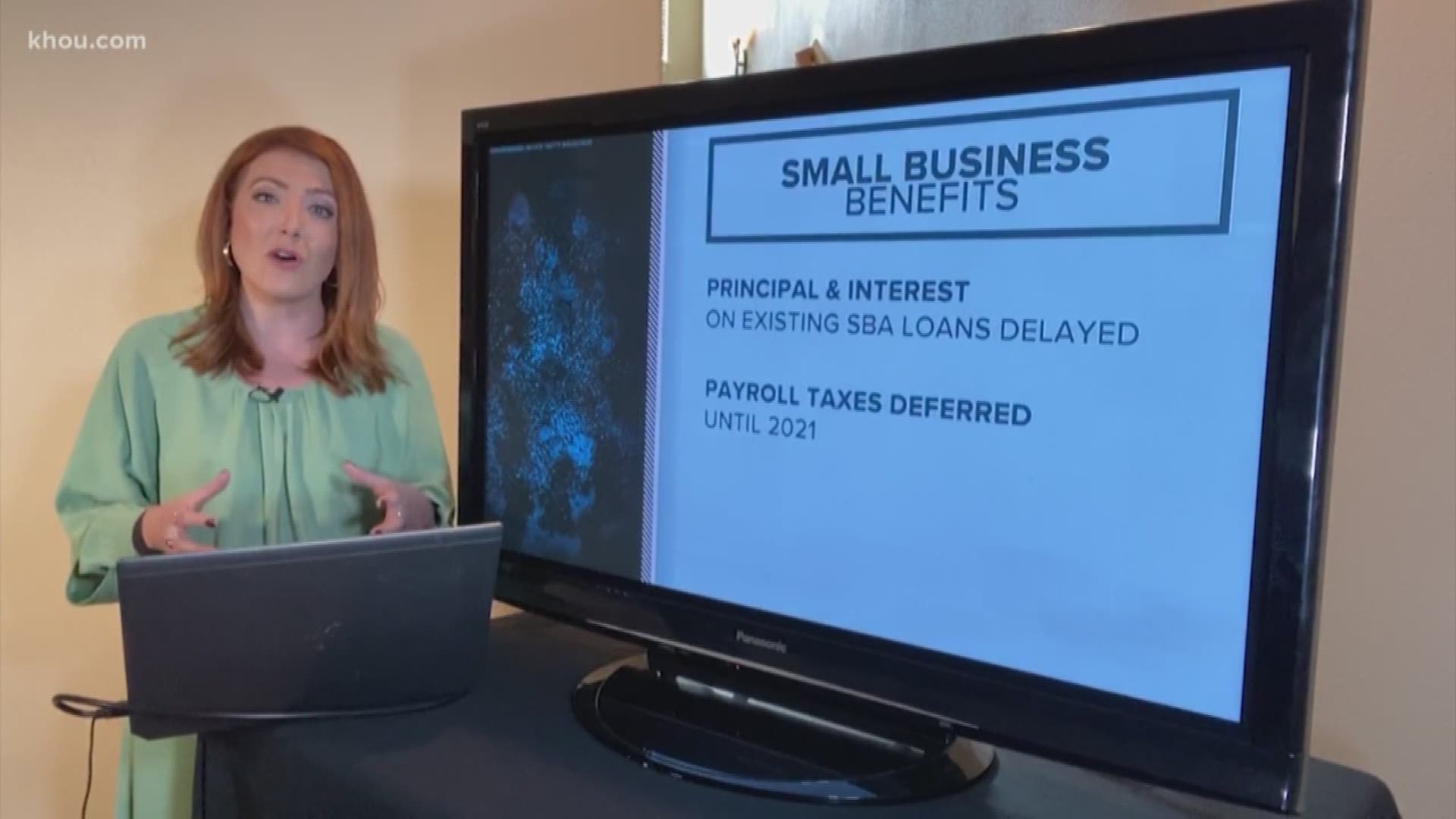

Already have an SBA loan? The principal and interest can be delayed up to six months.

The benefits don't end there.

Eligible businesses will also be able to defer their payroll taxes until 2021. They still have to pay but they can stall some.

Official FAQ from the U.S. Senate:

Where can I apply for the Paycheck Protection Program?

You can apply for the Paycheck Protection Program (PPP) at any lending institution that is approved to participate in the program through the existing U.S. Small Business Administration (SBA) 7(a) lending program and additional lenders approved by the Department of Treasury. This could be the bank you already use, or a nearby bank. There are thousands of banks that already participate in the SBA’s lending programs, including numerous community banks. You do not have to visit any government institution to apply for the program. You can call your bank or find SBA-approved lenders in your area through SBA’s online Lender Match tool. You can call your local Small Business Development Center or Women’s Business Center and they will provide free assistance and guide you to lenders.

Who is eligible for the loan?

You are eligible for a loan if you are a small business that employs 500 employees or fewer, or if your business is in an industry that has an employee-based size standard through SBA that is higher than 500 employees. In addition, if you are a restaurant, hotel, or a business that falls within the North American Industry Classification System (NAICS) code 72, “Accommodation and Food Services,” and each of your locations has 500 employees or fewer, you are eligible. Tribal businesses, 501(c)(19) veteran organizations, and 501(c)(3) nonprofits, including religious organizations, will be eligible for the program. Nonprofit organizations are subject to SBA’s affiliation standards. Independently owned franchises with under 500 employees, who are approved by SBA, are also eligible. Eligible franchises can be found through SBA’s Franchise Directory.

I am an independent contractor or gig economy worker, am I eligible?

Yes. Sole proprietors, independent contractors, gig economy workers, and self-employed individuals are all eligible for the Paycheck Protection Program.

What is the maximum amount I can borrow?

The amount any small business is eligible to borrow is 250 percent of their average monthly payroll expenses, up to a total of $10 million. This amount is intended to cover 8 weeks of payroll expenses and any additional amounts for making payments towards debt obligations. This 8 week period may be applied to any time frame between February 15, 2020 and June 30, 2020. Seasonal business expenses will be measured using a 12-week period beginning February 15, 2019, or March 1, 2019, whichever the seasonal employer chooses.

How can I use the money such that the loan will be forgiven?

The amount of principal that may be forgiven is equal to the sum of expenses for payroll, and existing interest payments on mortgages, rent payments, leases, and utility service agreements. Payroll costs include employee salaries (up to an annual rate of pay of $100,000), hourly wages and cash tips, paid sick or medical leave, and group health insurance premiums. If you would like to use the Paycheck Protection Program for other business-related expenses, like inventory, you can, but that portion of the loan will not be forgiven.

When is the loan forgiven?

The loan is forgiven at the end of the 8-week period after you take out the loan. Borrowers will work with lenders to verify covered expenses and the proper amount of forgiveness.

What is the covered period of the loan?

The covered period during which expenses can be forgiven extends from February 15, 2020 to June 30, 2020. Borrowers can choose which 8 weeks they want to count towards the covered period, which can start as early as February 15, 2020.

How much of my loan will be forgiven?

The purpose of the Paycheck Protection Program is to help you retain your employees, at their current base pay. If you keep all of your employees, the entirety of the loan will be forgiven. If you still lay off employees, the forgiveness will be reduced by the percent decrease in the number of employees. If your total payroll expenses on workers making less than $100,000 annually decreases by more than 25 percent, loan forgiveness will be reduced by the same amount. If you have already laid off some employees, you can still be forgiven for the full amount of your payroll cost if you rehire your employees by June 30, 2020.

Am I responsible for interest on the forgiven loan amount?

No, if the full principal of the PPP loan is forgiven, the borrower is not responsible for the interest accrued in the 8-week covered period. The remainder of the loan that is not forgiven will operate according to the loan terms agreed upon by you and the lender.

What are the interest rate and terms for the loan amount that is not forgiven?

The terms of the loan not forgiven may differ on a case-by-case basis. However, the maximum terms of the loan feature a 10-year term with interest capped at 4 percent and a 100 percent loan guarantee by the SBA. You will not have to pay any fees on the loan, and collateral requirements and personal guarantees are waived. Loan payments will be deferred for at least six months and up to one year starting at the origination of the loan.

When is the application deadline for the Paycheck Protection Program?

Applicants are eligible to apply for the PPP loan until June 30th, 2020.

I took out a bridge loan through my state, am I eligible to apply for the Paycheck Protection Program?

Yes, you can take out a state bridge loan and are still be eligible for the PPP loan.

If I have applied for, or received an Economic Injury Disaster Loan (EIDL) related to COVID- 19 before the Paycheck Protection Program became available, will I be able to refinance into a PPP loan?

Yes. If you received an EIDL loan related to COVID-19 between January 31, 2020 and the date at which the PPP becomes available, you would be able to refinance the EIDL into the PPP for loan forgiveness purposes. However, you may not take out an EIDL and a PPP for the same purposes. Remaining portions of the EIDL, for purposes other than those laid out in loan forgiveness terms for a PPP loan, would remain a loan. If you took advantage of an emergency EIDL grant award of up to $10,000, that amount would be subtracted from the amount forgiven under PPP.

=========

Coronavirus symptoms

The symptoms of coronavirus can be similar to the flu or a bad cold. Symptoms include a fever, cough and shortness of breath, according to the Centers for Disease Control. Some patients also have nausea, body aches, headaches and stomach issues. Losing your sense of taste and/or smell can also be an early warning sign.

Most healthy people will have mild symptoms. A study of more than 72,000 patients by the Centers for Disease Control in China showed 80 percent of the cases there were mild.

But infections can cause pneumonia, severe acute respiratory syndrome, kidney failure and even death, according to the World Health Organization. Older people with underlying health conditions are most at risk for becoming seriously ill. However, U.S. experts are seeing a significant number of younger people being hospitalized, including some in ICU.

The CDC believes symptoms may appear anywhere from two to 14 days after being exposed.

Human coronaviruses are usually spread through...

- The air by coughing or sneezing

- Close personal contact, such as touching or shaking hands

- Touching an object or surface with the virus on it, then touching your mouth, nose or eyes before washing your hands.

Help stop the spread of coronavirus

- Stay home when you are sick.

- Eat and sleep separately from your family members

- Use different utensils and dishes

- Cover your cough or sneeze with your arm, not your hand.

- If you use a tissue, throw it in the trash.

- Follow social distancing

Lower your risk

- Wash your hands often with soap and water for at least 20 seconds. If soap and water are not available, use an alcohol-based hand sanitizer.

- Avoid touching your eyes, nose, and mouth with unwashed hands.

- Avoid close contact with people who are sick.

- Clean and disinfect frequently touched objects and surfaces.

- If you are 60 or over and have an underlying health condition such as cardiovascular disease, diabetes or respiratory illnesses like asthma or COPD, the World Health Organization advises you to try to avoid crowds or places where you might interact with people who are sick.

Get complete coverage of the coronavirus by texting 'FACTS' to 713-526-1111.

MORE ON COVID-19