PERRY, Ga. — Georgians hoping to use the Georgia Dream program to purchase a home are reporting delays that have thwarted their path to homeownership.

The Georgia Dream Homeownership Program offers lower interest rates and down payment assistance for first time home buyers below certain income limits.

Chayla Kendall contacted 11Alive Investigates saying after she was approved for the program, her closing date was delayed four times over four months.

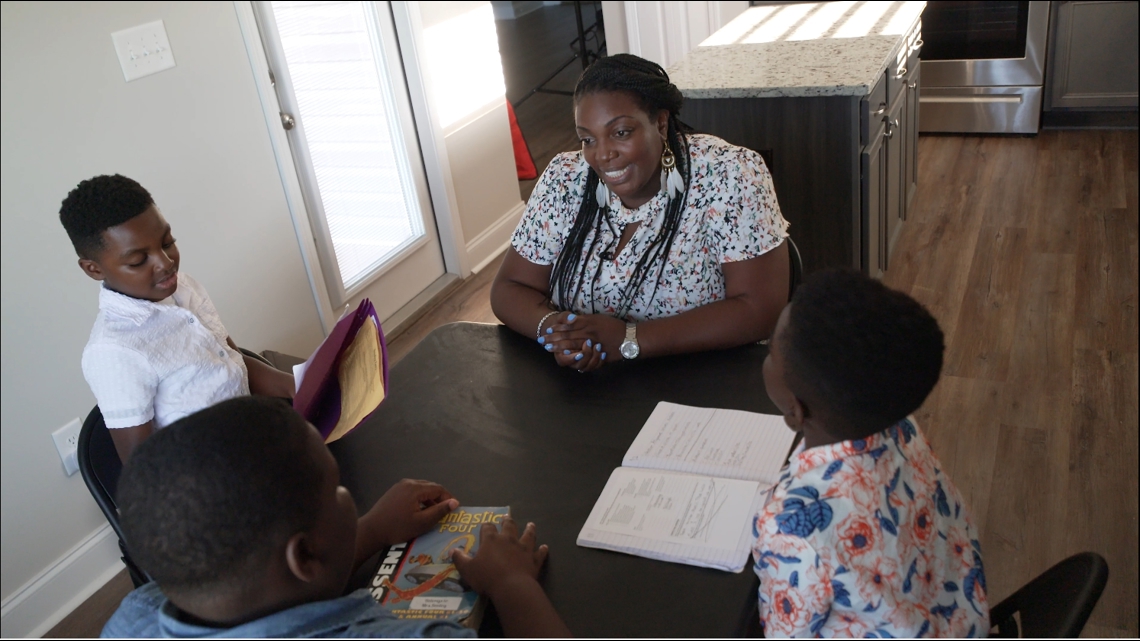

The teacher decided to move herself and her three sons from Gwinnett County to more affordable Perry, Georgia, where they found their dream home.

“I knew that I wanted my boys to have the American dream, to have a home, and be proud that we did this together," said Kendall. "When I was approved for the Georgia Dream, I was ecstatic, because that meant I wouldn't have to come out any money.”

Kendall said she chose to use DHI Mortgage from the program’s list of affiliated lenders. As a Georgia Dream recipient, she was required to send in a series of documents including tax returns, a credit report, and an application affidavit.

"I responded straight away when they asked me to upload something into the portal," Kendall said. "It would be literally three, maybe five hours, and I uploaded it."

Kendall said she went under contract and submitted her earnest money on April 27, 2024. By September, her closing date had been pushed back three times by the lender.

"They kept saying it's going to delay; Georgia Dreams takes time," Kendall recalled. "But to be able to come with down payment assistance and closing costs was something that I thought it would be worth the wait."

Wesley Brooks is the deputy commissioner for homeownership for Georgia's Department of Community Affairs, which runs the Dream program. He confirmed that the agency's processing times have been longer than usual.

“This summer, when we had an explosion in the housing market, we got up to about 14 business days to review a document," said Brooks. "In the spring, we were down to a 24-hour turnaround on most loans, as long as the documents were there. And that's where we want to be. We're not back to that point yet, but I want to be there."

Brooks said the DCA recently increased staffing and made leadership changes to improve processing times.

"We made sure that we've got the right folks with the right experience on board to get that to be a much smoother, faster, quicker process," he said.

When he learned of Kendall's four-month wait, Brooks said that long of a wait likely had more to do with the lender.

“Unless one of those lenders is getting us the right information, we can't process it, and that’s when you see those extended timelines," Brooks said. "The goal is to make sure that the lenders we're working with are reputable, they're trained, they know how to navigate our system, and that they really have the homebuyer's interest at heart."

While she waited for DHI Mortgage to schedule her closing date, Kendall moved to Perry with her sons in order to enroll them in school. They lived in a hotel room for several weeks and then moved into a temporary rental without furniture.

As the mandatory move-out date for their rental approached, Kendall still hadn't received an update from the lender.

"I believe that their goal was to frustrate me so I would walk away from the deal," she said. "The lenders want to make money, and the more money that the client comes out of pocket, the more money that they make. So it is a disconnect between the Georgia Dream and helping families and the lenders and making money."

Brooks said the DCA has occasionally removed affiliated lenders from the Georgia Dream program.

"We want folks to tell us, 'Hey, this isn't working with this loan officer and here's why,'" he said. "Then we can determine whether or not there's just some retraining that needs to happen or if maybe there's some malfeasance."

Kendall said DHI Mortgage had finally set her closing date for Aug. 28. She had 72 hours before she and her sons had to move out of their temporary rental.

The morning she was set to close, Kendall said the lender informed her they'd have to push it back a fourth time.

"DHI Mortgage claims they weren't able to reach the Georgia Dream to get final approval to release the down payment assistance to close," she said.

It was 124 days after Kendall had first gone under contract with the lender, and she was on the verge of homelessness.

11Alive Investigates contacted DHI Mortgage to ask why Kendall's close had been delayed again. An hour later, Kendall said the lender called to tell her she would be able to close that day after all.

"D.R. Horton and DHI Mortgage have worked closely with Ms. Kendall on the purchase of her new home," a spokesperson told 11Alive Investigates in an emailed statement. "Ms. Kendall’s loan application was completed and only awaiting final approvals from the Georgia DREAM program, which were just obtained today. We scheduled Ms. Kendall’s home closing for this afternoon and are very pleased to welcome her and her family to their new home."

11Alive Investigates asked DHI Mortgage to provide a timeline of when it submitted Kendall's documentation to the Georgia Dream program. As of the time of this publication, more than five weeks later, the company spokesperson still has not responded.

Kendall, who has moved into her new home, said she's glad she stood her ground. She hopes that by sharing her story, others will be encouraged to do the same.

“As a mother, the thing that you want to provide for your children is a safe place for them to stay," she said. "Walking away was not an option because my children were watching, and I wanted them to see an example of perseverance.”

How the Georgia Dream works

Those interested in applying for assistance through the Georgia Dream program can learn more here.

To qualify, applicants must have a household income up to the maximum, have liquid assets of no more than $20,000 or 20% of the sales price (whichever is greater), and meet mortgage loan credit requirements.

All eligible homebuyers qualify for down payment assistance of 5% of the property purchase price or a maximum of $10,000, whichever is the lesser amount.

Educators, veterans, healthcare professionals, public protectors like police, active military members, and those living with a family member who has a disability all qualify for down payment assistance of 6% of the property purchase price or a maximum of $12,500, whichever is the lesser amount.

The maximum home sales price allowable is $425,000. The income limit for 1-2 people is $120,439. The income limit for 3 or more people is $138,505.

In April 2024, the Department of Community Affairs launched the Peach Plus program to help even more homebuyers.

The Peach Plus program targets qualified borrowers not currently served by the traditional Georgia Dream program, and the first-time homebuyer requirement is waived for this program. Eligible homebuyers can receive down payment assistance of 3.5% of the purchase price with a maximum of $10,000.

Through Peach Plus, the maximum home sales price allowable is $525,000. The income limit for 1-2 people is $180,659. The income limit for 3 or more people is $207,758.

Learn more about the Peach Plus program here.