ATLANTA — When Raymond Constant needed some quick cash to pay overdue bills, he found himself walking into the Titlemax off highway 278 in Covington.

"They have those commercials on tv and they make it seem so friendly," Constant recalled. “When you go in they shake your hand, they talk to you real nice. They made it so easy."

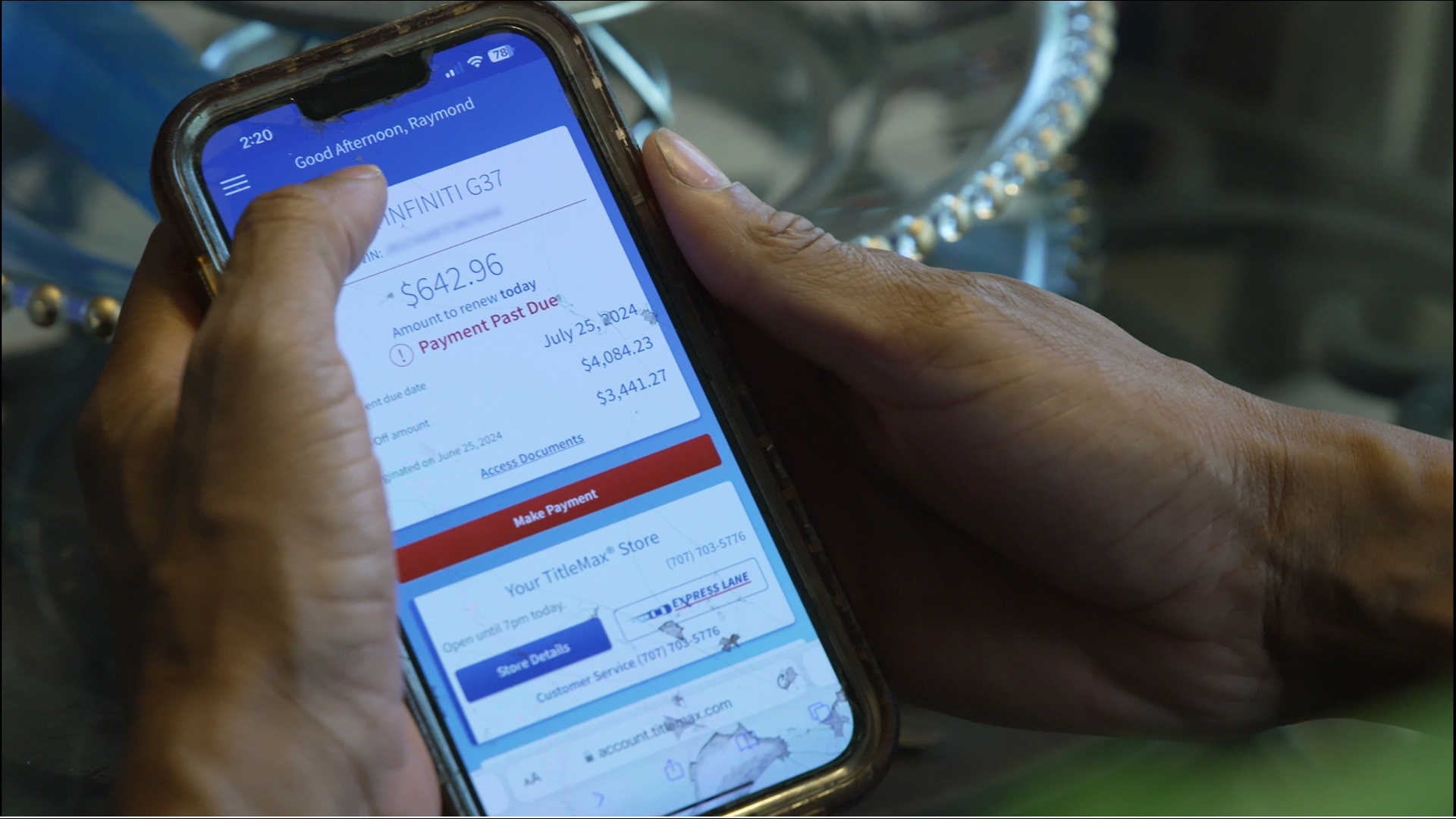

Constant said he was offered $3,000 in exchange for a lien on the title to his 2012 Infiniti.

"They put the check right in front of your face, right on the desk when they're talking to you," he said. "You're looking at the check like, 'I need that money.' So whatever else is being said, it's like you're not going to pay attention."

Constant admits he didn't fully understand what he was getting into when he agreed to sign the contract.

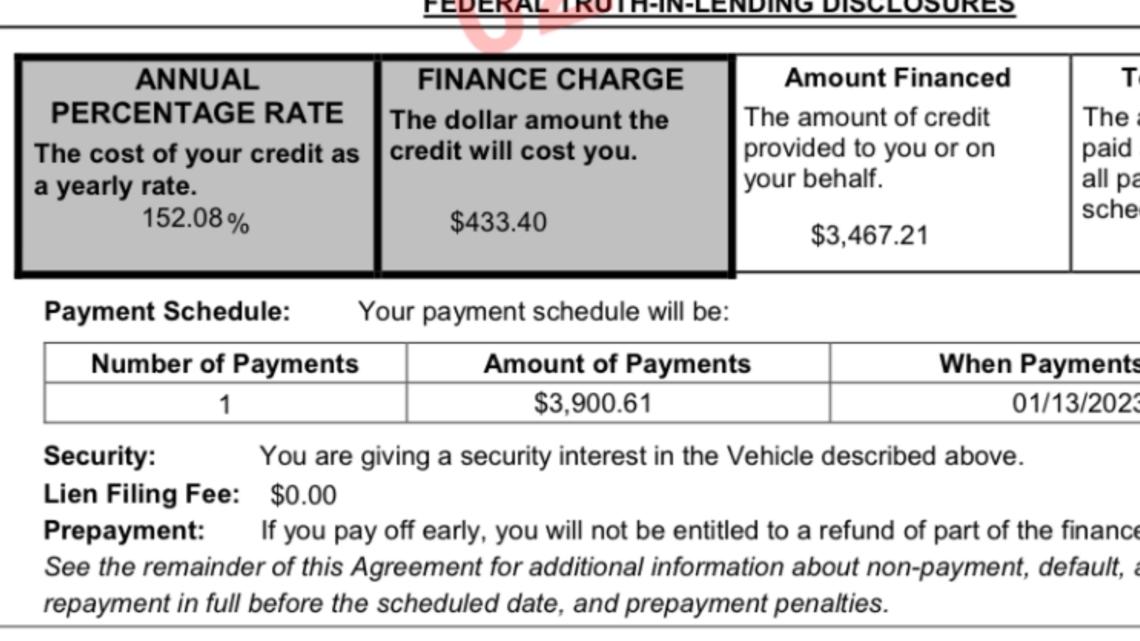

It was a standard title loan agreement. Constant would need to pay back the $3,000 plus interest within 30 days. He said the loan officer told him he could also extend the contract by paying $433 a month.

What Constant didn't realize was those payments would only cover fees and his 152% interest rate. After nearly three years of making monthly payments, he's forked over about $15,000. Not a penny of it has touched the original principal loan amount.

"It hasn't gone towards anything," he said. "It's a feeling of hopelessness. You can't scream. You can't do anything. It's just gone.”

Because the length of a title loan is 30 days, if the loan amount isn’t paid in full by then, the interest compounds quickly.

In Georgia, installment lenders are subject to regulation and an annual interest cap of 60%.

However, state law currently defines title lenders as pawn brokers, allowing them to charge up to 300% interest annually for the first three months and 150% after that.

"Somehow, they've managed to get this caveat that allows them to take advantage of Georgians in this way," said Liz Coyle, executive director of Georgia Watch.

Georgia Watch is a consumer advocacy group advocating to change the law to make title lenders subject to regulation and interest caps.

"They aren't even subject to regulation by the state Department of Banking and Finance, so it's really the wild, wild west," said Coyle. "The industry will tell you the average is 187% interest. That is a devastating amount of money. At that rate, they're able to trap a person in the cycle of debt."

In 2023, Rep. Josh Bonner (R-Fayetteville) introduced House Bill 342, which would have made title loans subject to the state's 60% cap on interest rates.

The bill never made it out of committee.

“The industry has deep roots, unfortunately, in the state," Coyle said. "We sometimes face 60 or 70 lobbyists that come from all over the country. They try to persuade lawmakers that they're doing Georgians a favor, that somehow people couldn’t get access to emergency funds any other way.”

Analysis by nonprofit newsrooms ProPublica and The Current found of the roughly 500 title pawn stores in Georgia about three-quarters operate in zip codes where the average household income is less than the state median of $71,355.

“They just prey on us," Constant said. "It has been pure hell. I'm very angry because I feel like I got robbed. I feel like I was manipulated. I feel angry because you're caught in a very bad situation because you don't want to lose your car."

In 2016, the federal government fined Titlemax's parent company, TMX Finance, $9 million for misleading customers in Georgia, Alabama, and Tennessee about the full costs of loans. That was about 1% of the company’s revenue that year.

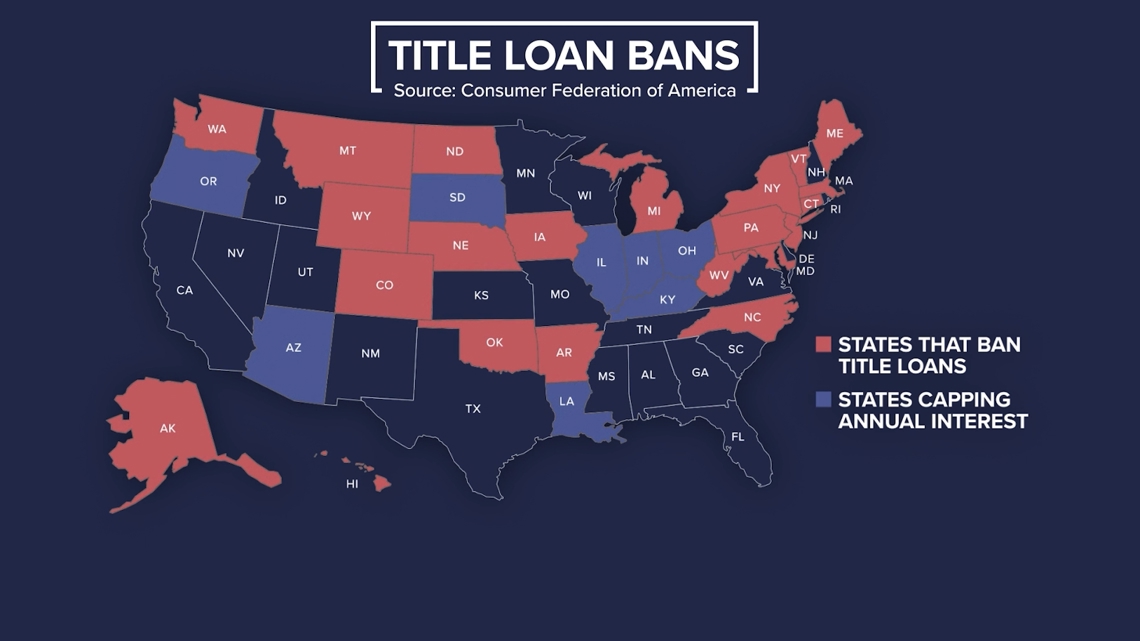

Twenty-three states have banned title lenders outright; five others have passed legislation capping annual interest rates at 36% or less.

But Georgia's law hasn’t budged any more than Constant's loan.

"You could pay for 100 years and the interest will never go down," he said. "It will never stop. And the minute you stop paying, they're going to repossess your car.”

11Alive Investigates reached out to TitleMax and several other title pawn companies that operate in Georgia multiple times over a four-week period for comment on this story. None of the companies appear to have a designated media spokesperson. Still, 11Alive emailed, called, and wrote to the companies' parent companies and corporate leaders. As of this publication, none of those companies or leaders have responded.

Alternatives to high-interest title loans

As an alternative or solution to high-interest title loans, Georgia Watch recommends three financial institutions that work with "high-risk" customers who may have low credit:

- On the Rise Financial offers one-on-one financial coaching and assistance accessing credit union and banking services.

- The Capital Good Fund is a nonprofit that offers financing options to those with less-than-perfect credit, as well as financial coaching and investment opportunities.

- Bank on Atlanta connects people to safe, affordable, and certified banking accounts. Bank On certified accounts offer no overdraft or hidden fees; a low minimum opening deposit; free deposits and withdrawals; and a low monthly fee.