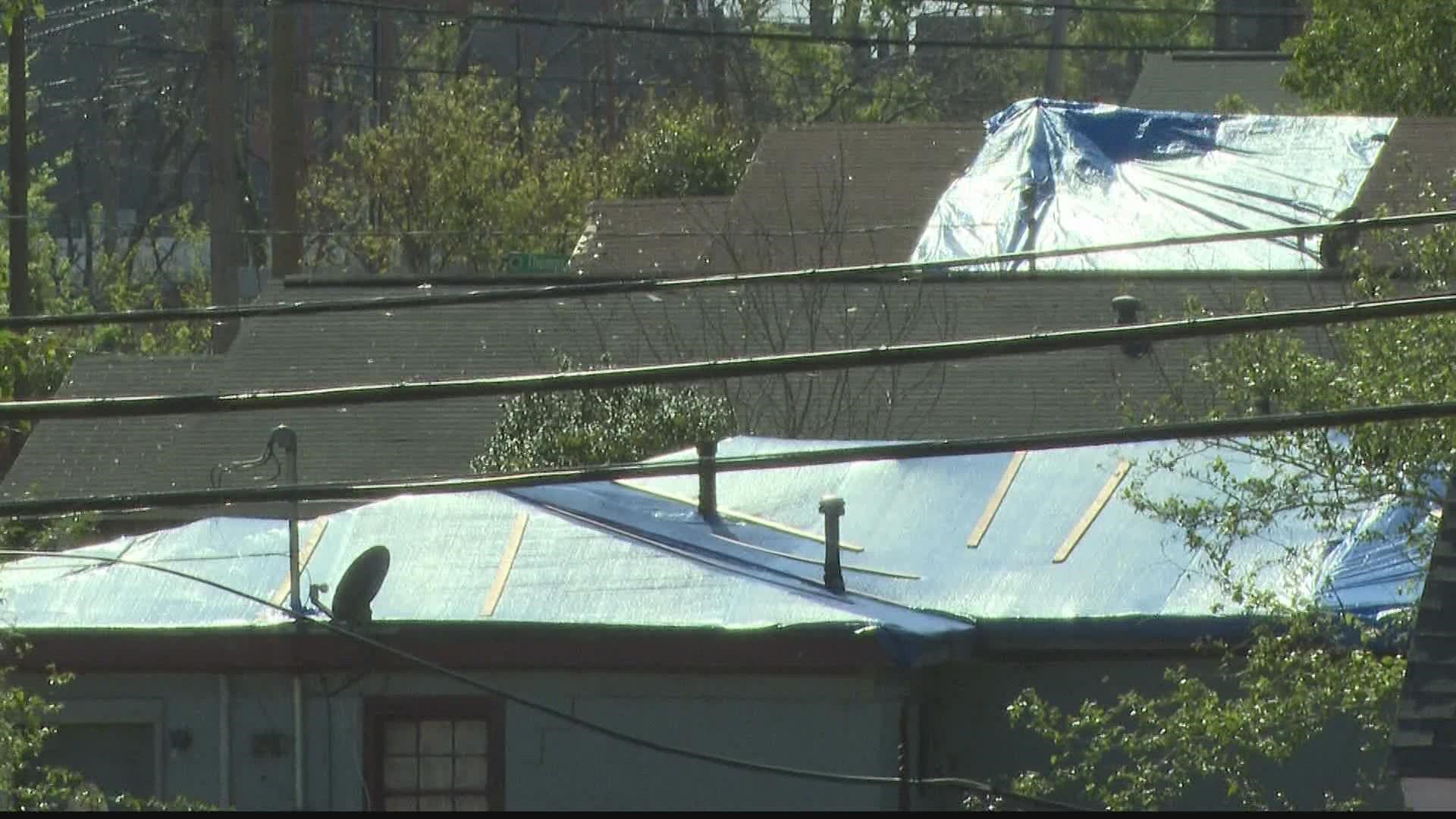

ATLANTA — It's been over a year since a deadly tornado tore through Newnan and many families are still waiting to return home.

“I've moved four times in one year," said Newnan homeowner Jennifer Rowe-Hall.

Rowe-Hall said her roof was pulled off and her home was lifted off its foundation when the tornado hit. And after months of back and forth with her insurance company, she said it's still not fixed.

“When you have something like this happen to you, you're in shock. You're in denial. You don't know what to do. You don't know where to begin," she said.

The Newnan local said the damage would cost just over $100,000 so far, but that adjusters have told her it could take up to $250,000 to ensure it's structurally sound and safe.

“I have one time to fix this right. And I'm not trying to do anything but be responsible," Rowe-Hall said.

After taking her concerns to social media, she found out she wasn't the only one having trouble.

"I've got two roofing companies and then I've got 20 other individual families that have shared similar stories," she said.

The Newnan homeowner is now speaking with more residents and planning to file a lawsuit alongside others.

“I will keep looking for an attorney or a law firm that wants to take this on, and then I'll just keep going from there and just keep documenting. Every week that goes by or every day. I'm still not being treated properly by State Farm, and I'm sure these other people aren't," adds Rowe-Hall.

A State Farm representative told 11 Alive they are looking into Jennifer's claims.

What insurance covers for a tornado in Georgia

Legally, the state of Georgia does not require insurance companies to cover 100 percent of the repair costs in the event of a tornado. The state of Georgia has a checklist for people who want to know what more about their own policies -- what's covered and what's not.

According to materials on the website of the Georgia Office of Commissioner of Insurance and Safety Fire, "most property insurance policies consider tornadoes a covered peril" even if they are not specifically mentioned, as "tornado losses are one event covered under the windstorm peril."

The state insurance department website also advises that "it is essential to meet with your insurance agent right away to go over your existing policies in preparation for severe weather."

The insurance company Allstate also notes that if your policy excludes wind damage, it will "probably not help cover the cost of repairs if your home is damaged by a tornado." It also warns that flood damage that comes with a tornado will likely not be covered unless you also have flood insurance.

If a tree falls onto your home, your policy may or may not cover that. Allstate explains:

For example, if wind caused the tree to topple onto your home, and your policy's covered perils include wind, you may find that your insurance company will help pay for repairs. On the other hand, if a maintenance-related issue caused the tree to fall on your home (say you neglected the tree and it was rotting), your homeowners insurance policy likely won't pay for repairs.

Across insurance advisers, the guidance is the same: Be aware of what is actually in your policy with your insurance company, because that will determine exactly what gets covered and exactly how much compensation you get for damage.

If you feel like your insurance company is unfairly putting you off and illegitimately denying your claim, there is some recourse you can try. Georgia has so-called "bad faith" laws that allow you to sue if the company is acting in bad faith.

Under those laws, actions that qualify as "bad faith" can include pressuring you into bad decisions or giving your bad advice, delaying payments on a valid claim, failing to communicate essential information or denying coverage for no valid reason.