ATLANTA — The housing market can be complex for buyers to navigate, but local experts say there are resources to help.

On Saturday, June 24, the Urban League of Greater Atlanta will host the annual "Super Saturday" event with experts, workshops and services to assist individuals and families on their path to homeownership. Upon completion of the course, participants can receive a certificate which makes them eligible for down payment assistance programs.

Experts emphasize such support and education as critical, given barriers of affordability, inventory and interest rates. Predatory lending also continues to be a problem, Natallie Keiser with HouseATL explained.

"When we think about homeownership, it continues to be important to encourage and incentivize homebuyers to participate in HUD-certified homebuyer education and counseling, which helps protect them," Keiser said.

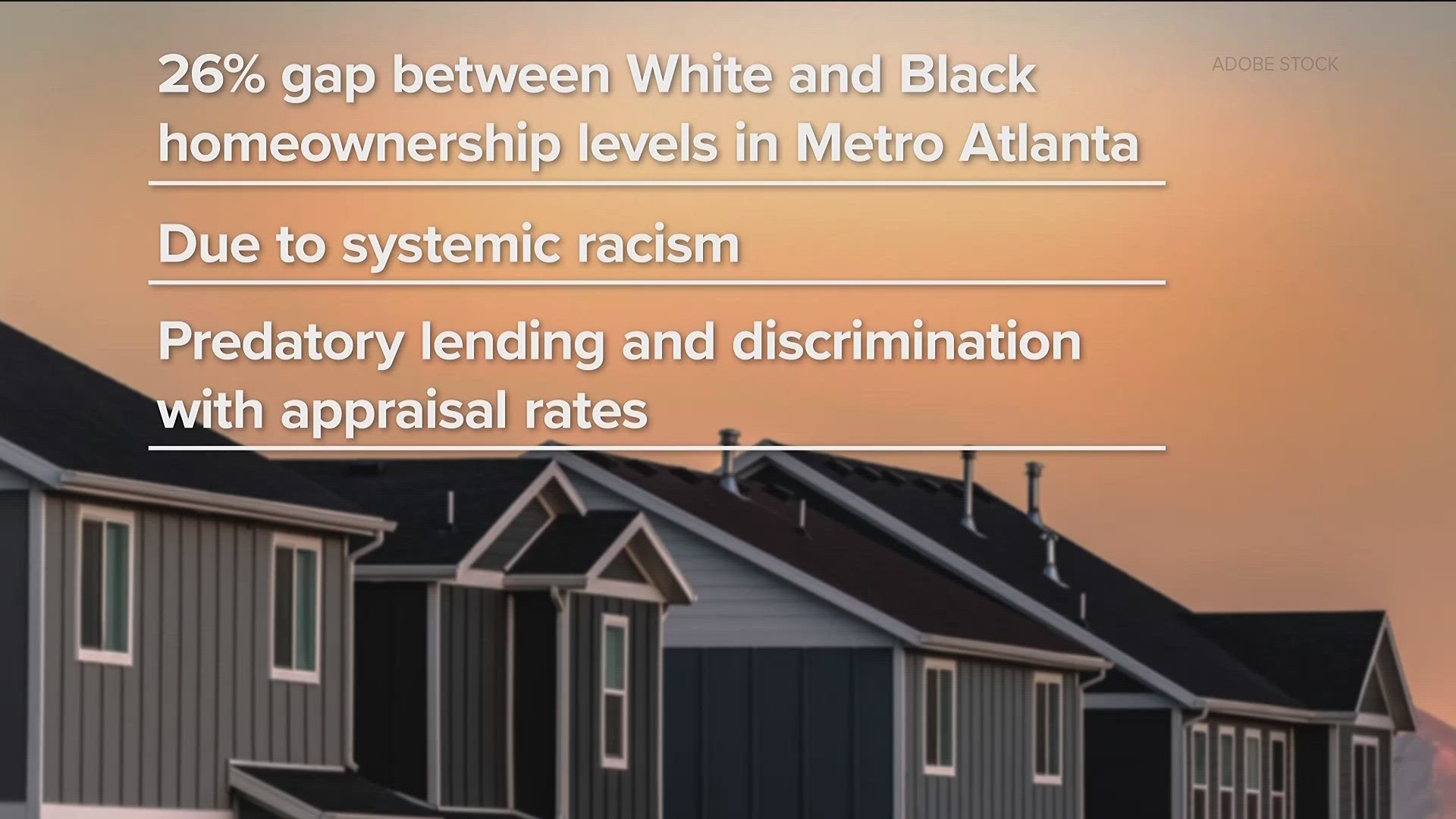

Groups like HouseATL, a taskforce addressing affordability in metro Atlanta, and the Urban League, are part of a collective led by the Community Foundation for Greater Atlanta, working to preserve and create 6,000 homeowners of color in Atlanta. The mission, part of Wells Fargo WORTH initiative, comes as metro Atlanta also deals with a 26% homeownership gap between Black and white households.

"Historically, there have been a number of systems in place that have made it difficult for Black families to own land in the early stages in the 1800s and 1900s right after Emancipation," Nancy Flake Johnson, President and CEO of the Urban League of Greater Atlanta, said. "And then it became more sophisticated in the form of redlining, even being able to get homeowner's insurance. Most recently, there's been several studies that have shown that appraisals have been biased, and not in just a little bit biased, but hundreds of thousands of dollars that directly impacts our ability to build wealth."

Affordability of the rental market can also have an impact, Keiser noted, adding to the difficulty of not only saving for a nonpayment but other fees like closing costs. The taskforce details problems the metro is facing in its latest report, with plans to release recommendations to address the issue this fall.

A "one stop shop" portal for prospective and existing homeowners, builders and industry professionals to come together is also in the works. The launch date of the portal is still forthcoming but Flake Johnson calls the plan a historic one.

"To buy a home, there are a lot of players," she said. "It's really important as a first time homebuyer that you take advantage of this free education so that you can learn the process, get prepared. And really, it's about sustaining homeownership. Not just getting the home, but keeping the home."