ATLANTA — Earlier this year, Suntrust Bank and BB&T merged with Truist, sparking complaints from some customers. Three months after the merger, customers said banking with Truist still comes with issues they're struggling to resolve.

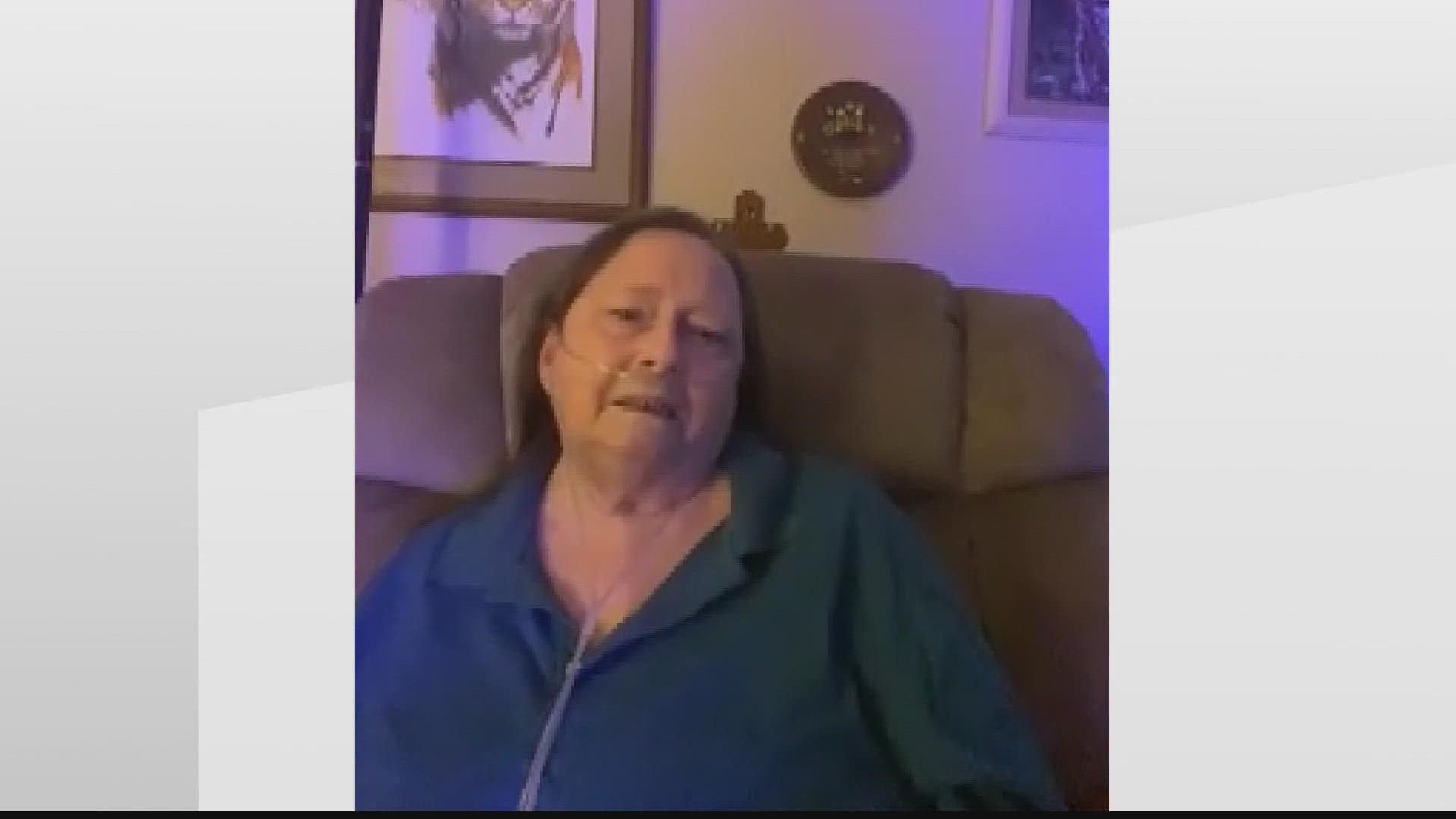

Millie Yakubek, 70, had been a Suntrust Bank customer for about two decades and said issues didn't start until the merger. Yakubek recalls that her checking account was frozen for the first time ever three months ago.

“They still accepted my social security check, and then they wouldn't let me have access to it," she said. "The only income I had, they put it in a checking account that I'm locked out of, then they keep it. It’s been depressing. I’m still upset by it.”

Her son, who has complete power of attorney due to Millie being disabled, tried fighting this. He went to the bank and even had their attorney call, but Millie said for two months it went nowhere.

"They said, 'Well, we did it for your own protection.' My own protection my foot," she said. "You weren't protecting me. You are starving me out. My house payment goes unpaid; all of my bills. So my house payment turns me into the credit bureau for having missed a payment."

Yakubek recognizes the bank suddenly reopened her checking account "out of nowhere," and was given a brand new debit card. She claims that less than seven hours later, she had three fraudulent charges for Comcast, totaling more than $780.

She said living on a fixed income, that's money she desperately needs.

“I got to have my medication or I’ll die to be frank," she said. "You can see I'm on oxygen 24/7 to get anywhere. One of my sons has to push me in a wheelchair."

RELATED: This Georgia man realized $2,000 was missing from his Truist Bank account -- so he called 11Alive

As a customer, she said she has called multiple departments within Truist to no avail. She wants the money back and hopes Truist will pay for the late charges on her bills and give her an apology.

“I ended up coming up with the money to pay for my medication. We made it through because I had some money, some cash. Had I not, I don't know what we would do," she said.

11Alive reached out to Truist, which says it takes client concerns and potential fraud concerns very seriously. It added that it will escalate her concerns to the appropriate team.

11Alive's Paola Suro has given the bank Yakubek's contact information and specifics on her case so they can connect and get things solved.

Here's the full statement from Truist:

Protecting our clients and their accounts continues to be a top priority for us and we take any potential fraud concerns very seriously. As I mentioned, we’ve escalated this concern to the appropriate team.

All financial institutions across the country are experiencing escalated fraud attacks from criminals. The Federal Trade Commission has reported a more than 80% increase in incidents since 2019. That’s why we continue to diligently educate our clients on the current fraud schemes many consumers are facing across the industry, and share resources on how they can keep their accounts and personal information safe and secure to help prevent fraud.

We also provide tools, tips, and resources on our website that clients can visit to learn more:

- Learn how to protect your accounts and information

- Learn how to protect against fraud

Thanks again for flagging this concern. Someone from our client service teams will be in contact with the account holder directly.