ATLANTA — The tax deadline has come and gone, and now many of us wait for the anticipation of money back. But some have filed their return only to feel frustrated. In fact, posts online claim agencies like the U.S. Department of Education are swiping refunds.

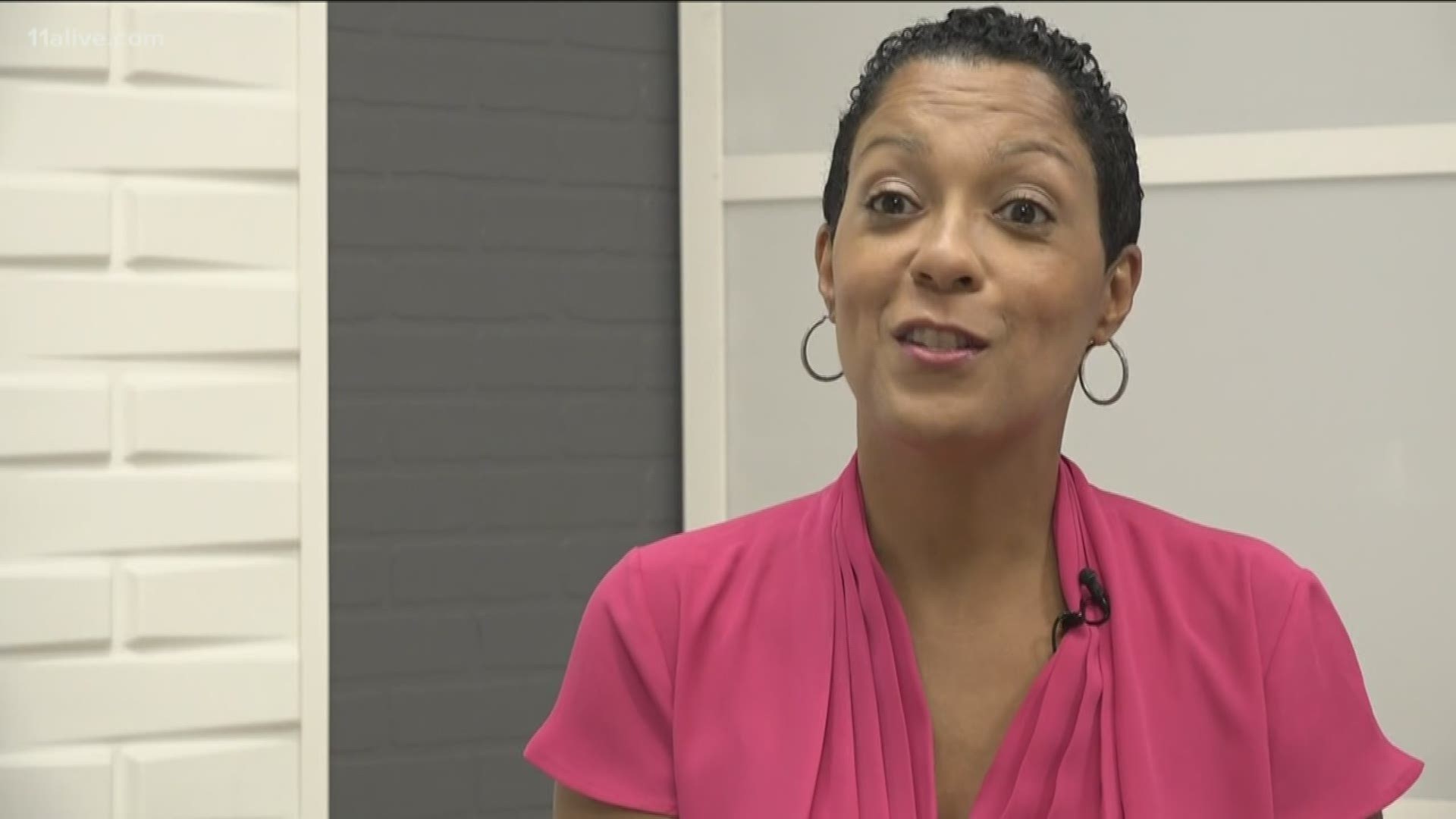

So when is your refund not yours to cash and intended for the government instead? 11Alive's Liza Lucas turned to financial expert Jini Thornton to VERIFY.

“If you're in default on federally backed student loans, they are definitely going to take that refund,” Thornton explained.

Hold on. Before everyone with a college loan panics, this is specific, according to Thornton.

“In instances when your loan is in default, not deferment,” she said. “Deferment means you've made arrangements. You can't pay right now for whatever reason and you’re going to make your payments later on. You have an arrangements with your lender.”

That's different from being in default status.

“Default means you're supposed to make payments,” Thornton said. “You've not made an agreement with your lender. Again, they will take that refund and apply it to that loan balance.”

The withholding is known as a tax refund offset, or treasury offset, and it’s not the only reason your refund could be reduced or taken altogether.

“The obvious is because you owe tax for the current year you're filing, or maybe a previous tax year,” Thornton said. “If you're behind on court ordered child support, the IRS is definitely going to keep your refund.”

In addition, Thornton said your refund could be retained if you owe another federal agency.

According to the Taxpayer Advocate Service (TAS), offsets may occur in regards to the following debts.

- Past-due federal tax;

- State income tax;

- State unemployment compensation debts;

- Child support;

- Spousal support; and

- Federal non-tax debt, like student loans.

For federal tax offsets, you’ll get an IRS notice, according to TAS. For all other offsets, the notice will come from BFS. Learn more about your rights to dispute the IRS’ here.