Another 2 million stimulus payments approved under the American Rescue Plan, COVID-19 relief bill, started showing up in bank accounts and by mail Wednesday. The Internal Revenue Service said this includes money for Veterans and for Americans who are getting a extra money because their income changed in 2020.

Americans who made up to $75,000 in 2020 will get the maximum $1,400 check under the American Rescue Plan. Couples who file taxes jointly and made up to $150,000 will get $2,800. The amount received decreases to zero for individuals who made up to $80,000 and couples who earned $160,000. There's a $1,400 kicker for each dependent in the household.

Wednesday's payments mark the fifth batch of checks to go out since the bill was signed by President Joe Biden on March 11. The IRS said this batch includes more than 320,000 payments to Veterans Affairs beneficiaries who don't normally file a tax return and did not use the IRS's non-filers tool last year.

There are also 700,000 "plus-up" payments worth more than $1.2 billion in this batch, the IRS said. These recipients may not initially have been eligible to receive the payments based on their 2019 tax returns because they made too much income, but they do now because they lost income in 2020. Now that they filed their 2020 returns to report this income loss or if they added a dependent, they are now eligible.

Additionally, the IRS said nearly 850,000 went to people for whom the agency did not previously have the information necessary to issue the payments. They now have the information because these people filed a 2020 tax return.

And 72,000 payments went to Social Security beneficiaries who did not file a tax return in the last two years.

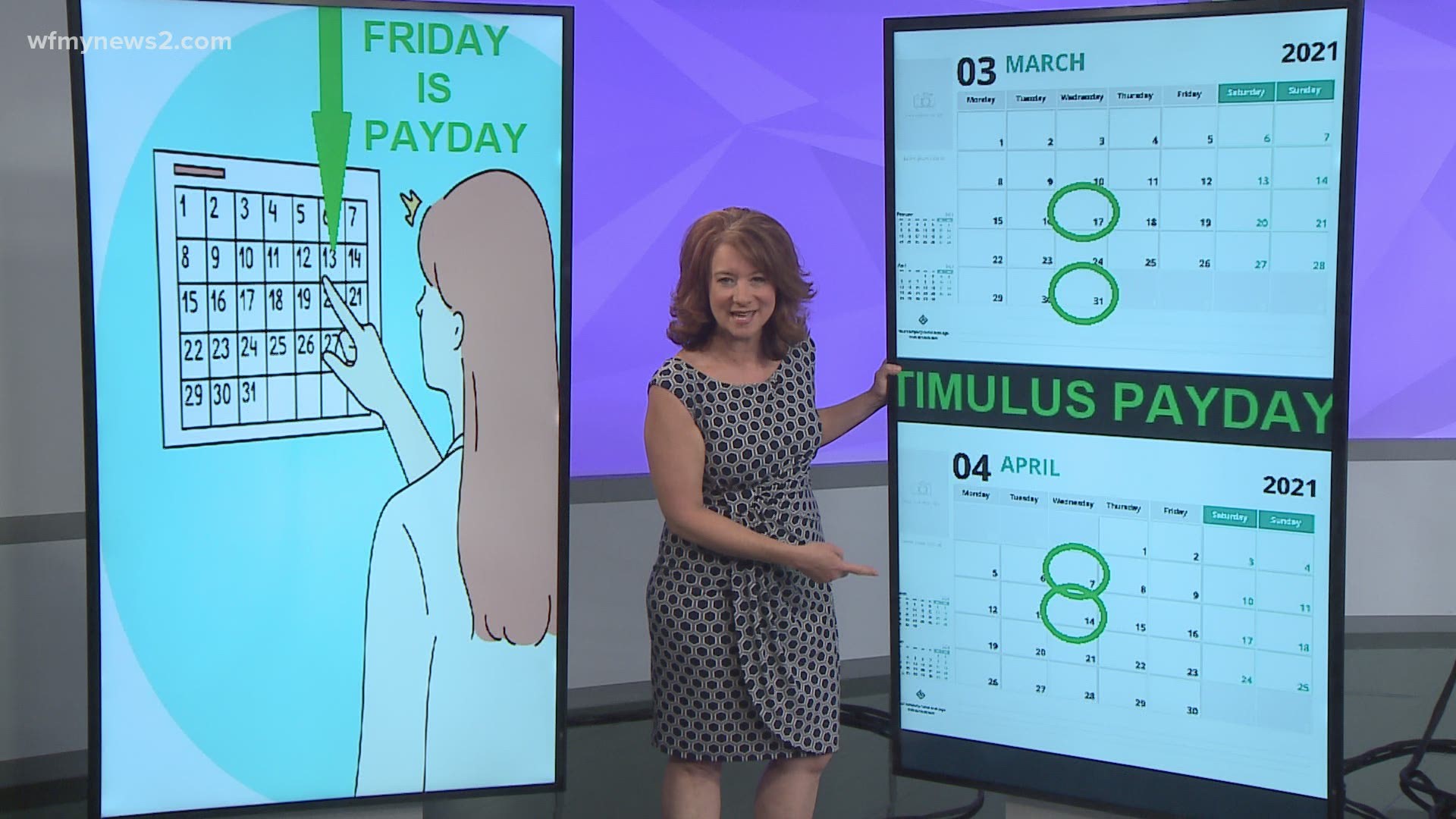

The IRS said it has now delivered 159 million payments worth more than $376 billion since the first batch went out on March 17. Of the 2 million payments that started arriving Wednesday, 1.2 million arrived by direct deposit and the other 800,000 were sent in the mail as a paper check.

Stimulus payments will continue weekly until all eligible individuals are paid, the IRS said.