ATLANTA — Georgia lawmakers would rein in the state’s film tax credit -- just a bit -- under a bill introduced this week. Audits have shown that the generous tax credit was even more generous than state officials knew.

Georgia’s film tax credit is the most generous in America. This bill would keep it generous, according to the sponsor.

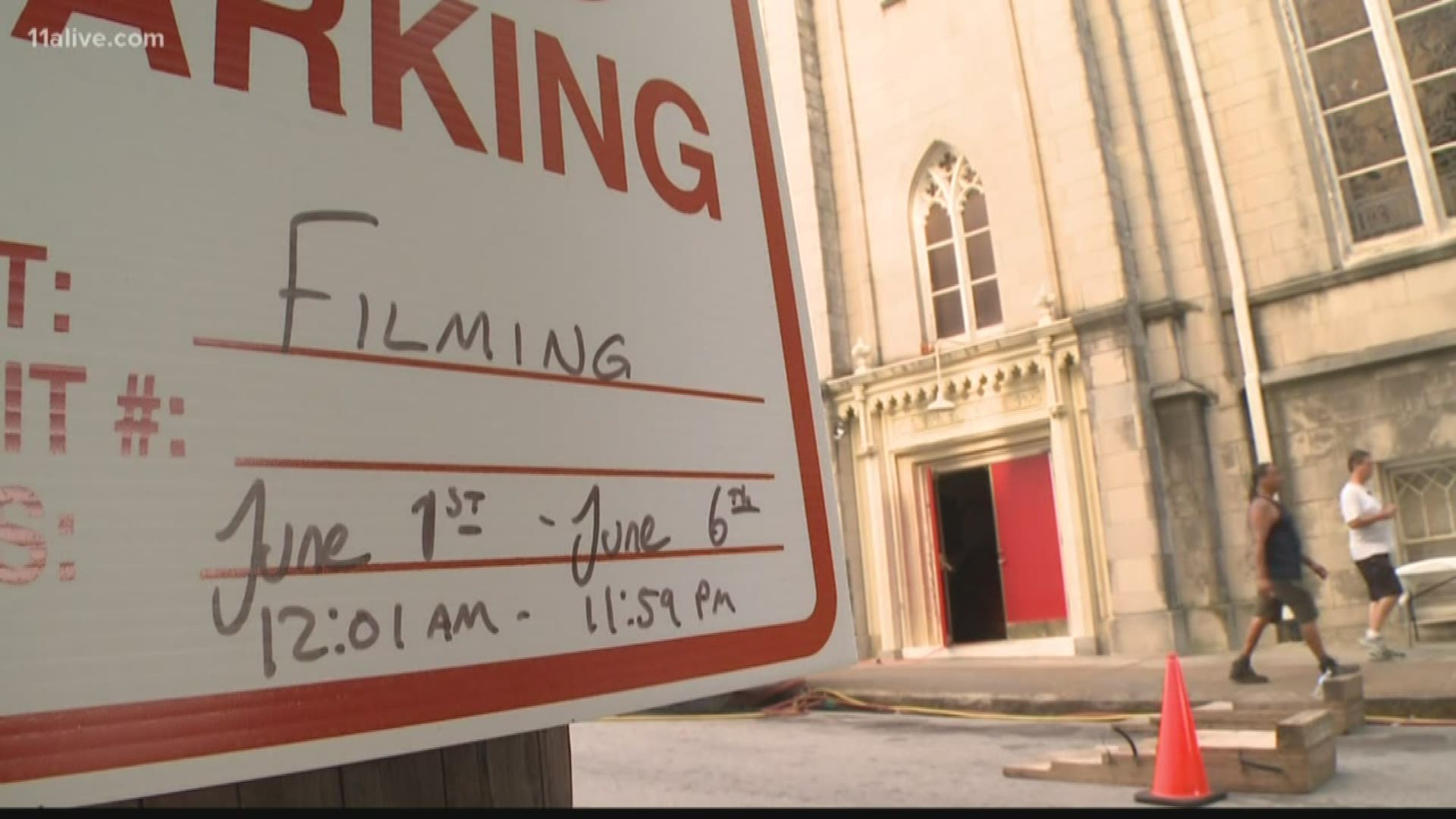

Georgia’s film industry is thriving largely because of billions of dollars in state government subsidies. Yet, a recent audit showed that filmmakers got tax credits for ineligible expenses, including work done outside of Georgia, and for expenses unrelated to film production.

State Rep. Matt Dollar (R-Marietta) is behind a bill that he said would update the film tax credit, especially in light of that critical state audit.

"The tax credit has been wildly successful in Georgia," Dollar said Thursday.

"It wasn’t too generous, but there were some problems with the process and it needed to be updated. So that’s what this bill does."

Among other things, Dollar’s bill requires more paperwork, more audits of tax credit applications, and tightens the requirement for tax credits for in-state expenses only.

The state had boasted that the film industry put $9.5 billion into the economy. Audits showed that amount was greatly exaggerated. Yet, Dollar and other backers of the tax credit said the legislature needs to only fix the program started 12 years ago and not overhaul it completely.

"Technology has changed tremendously since that time. And the industry in the state has changed a lot since that time. So it’s time for an update," Dollar said.

OTHER HEADLINES: