GEORGIA, — New laws will take effect in Georgia starting Jan. 1, 2025, introducing significant changes in tax policy, election laws, and education.

Reforms for economic systems

Senate Bill 366 aims to improve transparency and oversight of tax expenditures in Georgia. The law requires at least 12 economic analyses annually on tax expenditures, prioritizing those expiring within two years or costing over $20 million.

It mandates detailed summaries of tax expenditures in the governor’s budget and annual reviews by legislative committees. Stakeholders, including economists and business leaders, will contribute to evaluations. This bill enhances accountability in Georgia’s tax system.

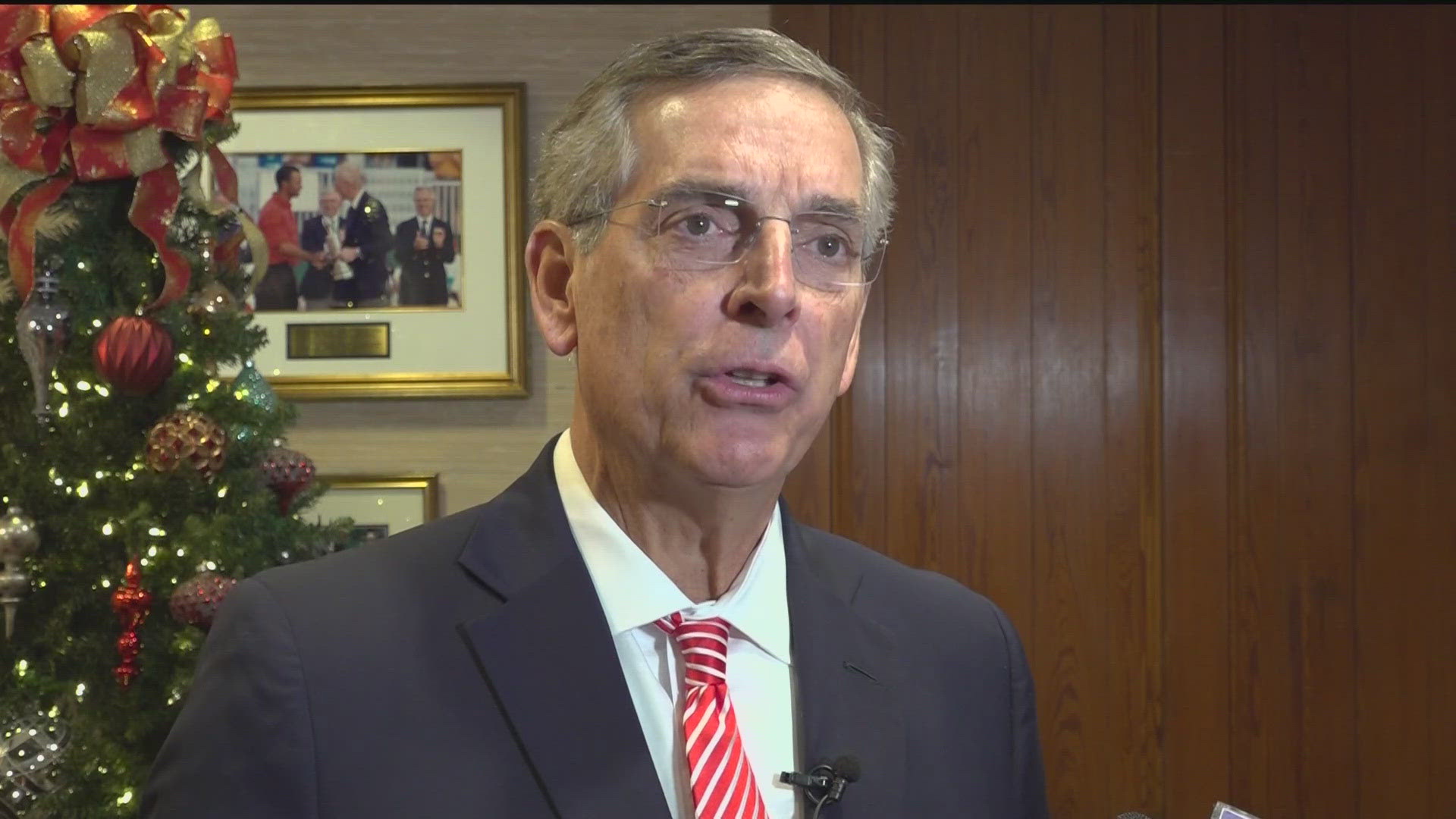

Changes in election policy

Senate Bill 212 will bring key changes to election processes in Georgia starting Jan. 1, 2025. It eliminates probate court judges' roles in elections, replacing them with dedicated county boards of elections and registration in counties where judges previously served as election superintendents.

The new boards will manage elections, voter registration, and absentee voting. SB 212 also defines the powers of the boards, member selection procedures, and the roles of election supervisors and staff. Counties such as Baldwin, Dodge, and Gilmer will transition to this new system.

The law aims to streamline and standardize election administration statewide.

School vouchers for Georgia students

The Georgia Promise Scholarship Act (Senate Bill 233) will launch in the 2025-26 academic year. It will provide up to $6,500 per student annually for private school tuition, homeschooling, or other eligible education expenses.

Students must be zoned to one of Georgia’s lowest-performing 25% of schools or entering kindergarten in such a zone. Additionally, students must have attended a low-performing public school for at least one year unless entering kindergarten.