ATLANTA — There are important state measures Georgia wants voters to decide on come Election Day.

The issues will be on every Georgia voter's ballot, asking them to weigh in on proposed state constitutional amendments and a referendum.

One of those measures pertains to the personal property tax exemption increase. Here's what to know.

Personal property tax exemption increase

Ballot question:

Do you approve the Act that increases an exemption from property tax for all tangible personal property from $7,500.00 to $20,000.00?

Explanation:

This ballot measure is more straight forward. It's asking voters if they approve increasing the personal property tax exemption from $7,500 to $20,000.

Personal property includes furniture, fixtures, machinery and other property used in a business as well as aircrafts and boats owned by an individual or corporation.

Yes means you approve increasing the exemption to $20,000.

No means striking down this increase.

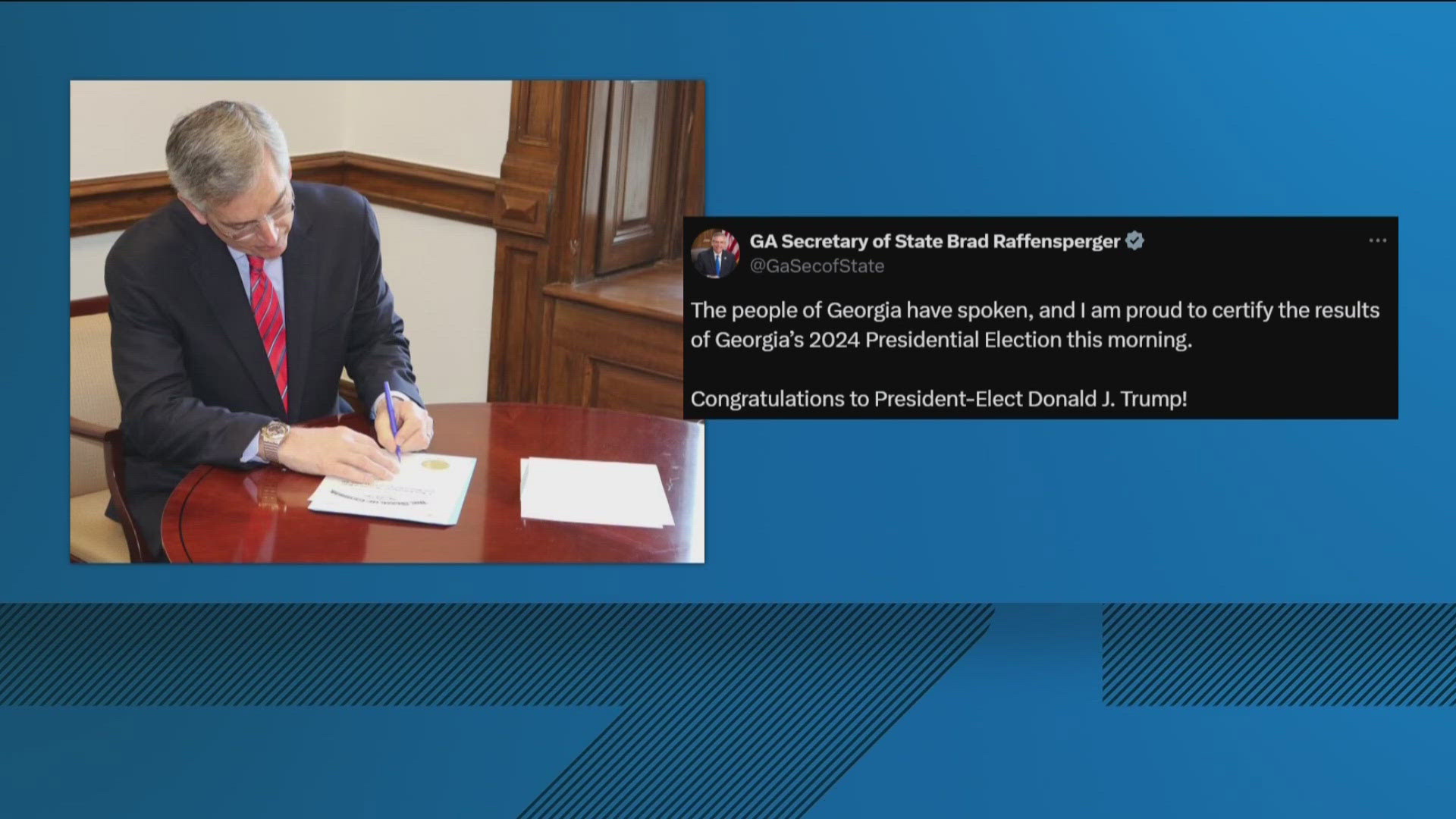

This question is available on Georgia's sample ballots. To check out your sample ballot, the greatest resource is the Georgia Secretary of State's website. Click on My Voter Page, enter your voter information, and click on the sample ballot section.

RELATED: Georgia voters will respond to these 3 statewide measures in November

Watch the videos in the YouTube playlist below so you're caught up on what you need to know before you head to the polls:

11Alive is committed to helping you vote confidently by understanding the 2024 election issues that impact you. Our goal is to educate and inform our audience about the election process. We plan to do that by verifying facts, providing context, and explaining the system. Get more election resources here at /vote.