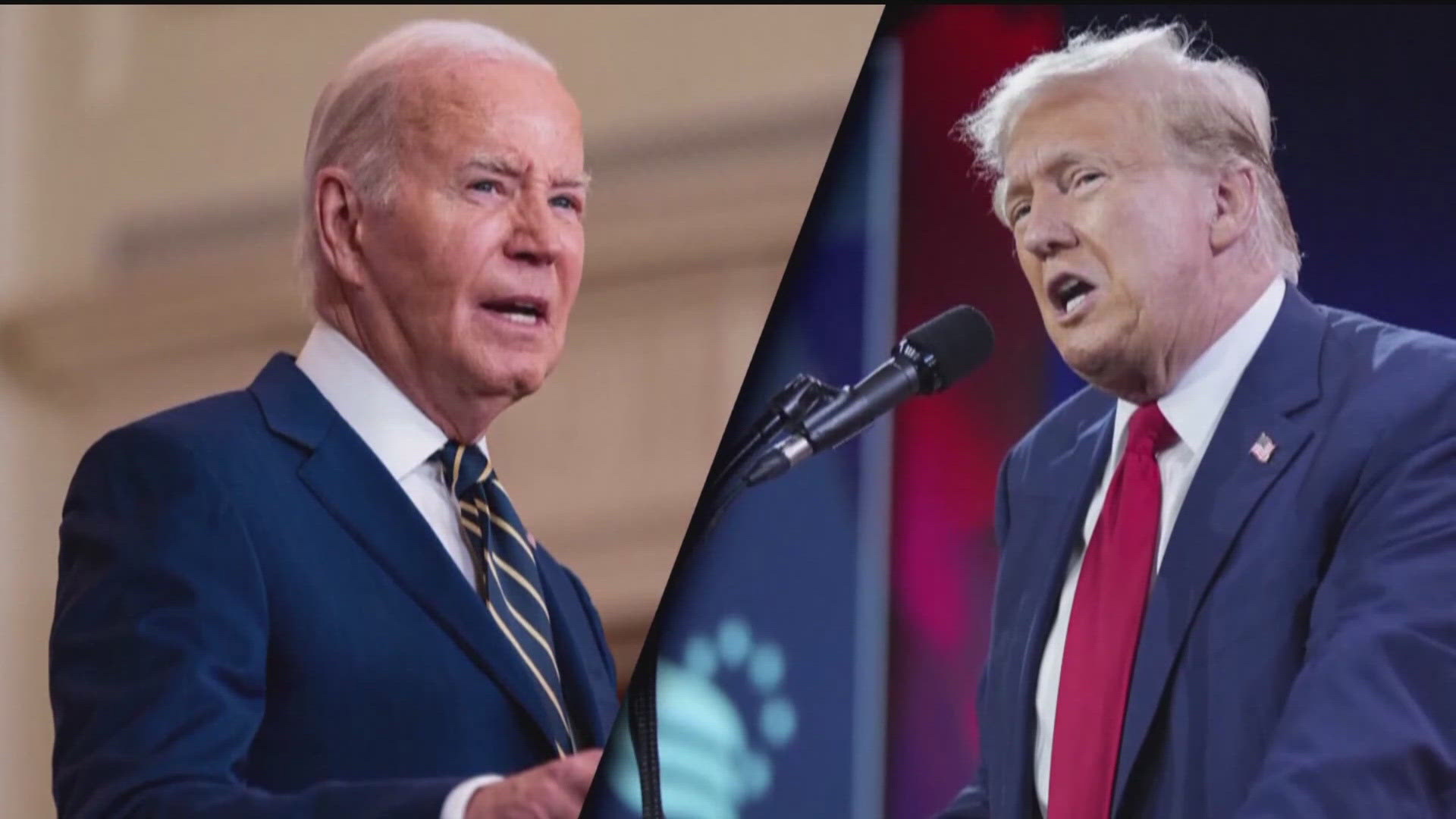

ATLANTA — Taxes will be one of the key topics expected to crop up during Thursday night's presidential debate between President Joe Biden and former President Donald Trump.

Each candidate has their own plan. Former President Trump has made it known he would like to continue the current round of tax cuts put into place in 2017 under his watch.

Meanwhile, Biden wants to raise taxes on billionaires and corporations and keep taxes steady or lower them for those making less than $400,000 a year.

Armand Kadima, an accountant with MedFirm LLC, said the Tax Cuts and Jobs Act signed by former President Trump, favored entrepreneurs and small business owners. He said it also allowed more businesses to stay in business and keep more employees.

"It really incentivized a lot of entrepreneurs into taking advantage of a lot of the new provisions that were passed in 2017, such as the bonus depreciations, deduction of 20% of pass-through incomes," Kadima said. “These were all benefits that allowed entrepreneurs to help leverage the tax code and help them reduce their tax liabilities. I saw a lot of them really bolster their financial position, their cash position because they didn't have to shell out as much in taxes."

The Congressional Budget Office, a nonpartisan entity, said keeping the Trump tax cuts would add an estimated $3.3 trillion to the national debt over the next ten years. Tax expert Andrew Poulos called the 2017 tax law one of the biggest changes to the system in decades. He thinks President Biden's bid to upend the current tax system is ambitious.

"From a political perspective, for votes, President Biden is trying to get, I don't know how realistic it's going to be to get everything he wants accomplished and if it will happen," Poulos said. “Every single change, the Internal Revenue Service has got to go back and make changes, update forms and systems, a lot of their systems are antiquated as it is, which is challenging.”

Earlier this month, 11Alive attended the Juneteenth Regional Reporters Summit at the White House. There, The White House's National Economic Council deputy director Daniel Hornung said he saw opportunity as the Trump tax cuts are set to expire at the end of 2025.

"There will be a moment in 2025 where we can fundamentally change the tax code," Hornung said. "It’s a moment to reimagine how our tax policy works and make it work for the middle class. For folks making below $400,000, their taxes will not go up. But he's going to raise taxes on the wealthiest Americans and on large corporations. We're asking those very big corporations to pay their fair share and using that revenue to fund tax cuts for the middle class, using that revenue to fund key investments in national priorities."

For example, Hornung mentioned resurrecting the pandemic-era child tax credit or earned income tax credit. To pay for those, the Biden Administration tax proposal calls for raising the corporate tax rate from 21% to 28%, imposing a minimum 25% income tax on billionaires, increasing the marginal tax rate among the highest incomes from 37% to 39.6% and boosting taxes on capital gains for high earners.

"It could result in potential layoffs," Kadima said of Biden's proposed plan. "It could impact them to where they have to figure out ways to offset that increase in taxes. It would be very detrimental to entrepreneurs and business owners because they’ve been riding this wave of lower tax rates, especially at the corporate tax level. We call it the Robinhood strategy: take from the rich and give to the poor."

Under the current tax plan, tax write-offs via deductions largely decreased due to the raised limit the tax law imposed. C-corporations paying the corporate tax rate also saw relief from the double whammy of taxation. Trump has recently stated to fellow Republicans that he favored imposing tariffs on foreign countries and phasing out the income tax. The former president also suggested doing away with taxes on tips.

Congress will ultimately have to pass a new tax bill, which the president would then sign into law. Kadima said no matter which direction the tax system goes, each plan must have balance in mind. Both Biden and Trump are set to debate Thursday night at 9 p.m. at CNN's studios in Atlanta.