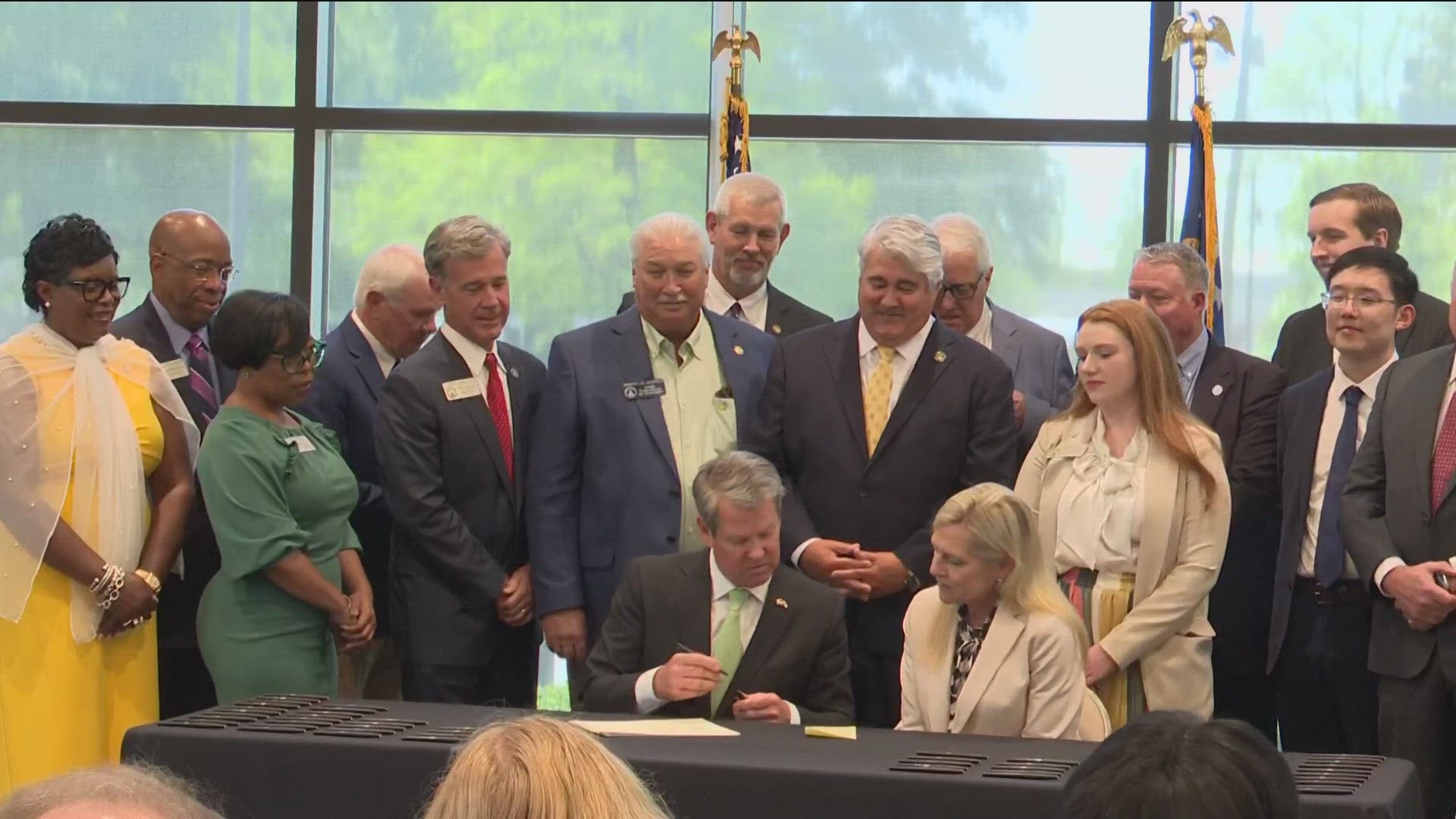

ATLANTA — Georgia Gov. Brian Kemp officially signed tax cuts that he said would help individuals and businesses in the Peach State on Thursday.

He signed a total of six bills into law in the Augusta Municipal Building on Thursday.

The governor also delivered remarks before signing the bills.

"That is thanks to our responsible conservative approach to budgeting that we'll be able to sign this legislation knowing that Georgia will still be financially sound no matter what the economic forces are ahead of us in the state," Gov. Kemp said on Thursday before signing the bills. "Instead of following the lead of tax and spend... we are prioritizing the services our citizens need and working hard to cut and not raise our taxes."

Here's a list of the bills the governor signed into law:

House Bill 1015

This is one of the more consequential bills that Kemp said would help many Georgians save extra money in their pockets by accelerating the largest state income tax cut in its history.

The tax rate is currently 5.49%, and the governor is proposing to reduce it by 0.1% each year, which would bring it down to 4.99% if the state revenues hold up.

House Bill 1437

In 2022, Georgia's tax rate gained a flat income tax rate of 5.49%, transitioning away from a series of income brackets that topped at 5.75%.

This bill would take the tax rate from 5.49% to 5.39% for the 2024 year. According to the governor's office, this will mark a cut of 36 basis points from the recent 2023 tax year.

Gov. Kemp's office said in a news release that this will save Georgians over $1 billion when they file their 2024 tax returns.

"Because we realize Georgians know best how to spend their money a lot better than the government does," the governor added.

House Bill 581

According to the governor's office, House Bill 581 will allow each Georgia county to provide a statewide homestead valuation freeze.

The freeze limits the appreciation of property values to the inflation rate.

In his remarks, Kemp stated that each bill will help residents battle inflation prices.

"Each of the bills I sign today will also help hardworking Georgians buy through high grocery prices and high energy prices and an inflationary environment that we have been in for several years now," Kemp said at the signing ceremony.

Officials stated that the bill would also provide a special local option sales tax for each county to help with property tax relief.

House Bill 1021

This bill would increase the state's income tax dependent exemption by 33%. This would allow each taxpayer to deduct $4,000 per dependent rather than $3,000.

"We're hoping this extra $1,000 deduction per child will help alleviate some of those costs for parents in our state," Speaker of the House Jon Burns previously said before the bill was signed into law.

Burns is also one of those who signed off on the legislation.

House Bill 1023

This bill will also extend tax cuts to businesses by lowering the corporate income tax from 5.75% to 5.39%.

It would match the corporate income tax rate to the individual tax rate for the 2024 Tax Year.

A news release stated the bill would help with, "Furthering our state's commitment to maintaining a business-friendly environment that creates good-paying jobs throughout the state for hardworking Georgians."

Senate Bill 496

The only Senate-led tax-related bill to make it to the governor's desk will make the process easier for some homes and buildings to become historic.

It also extended the sunsets for the tax credits for rehabilitating these historic homes to December 31, 2029.

Rural zone revitalization is also included in this bill and for certain tax credits to December 31, 2032.

"Washington D.C. politicians are currently working to raise taxes on hardworking Americans, but here in Georgia, we are keeping to our commitment to grow our economy and opportunity for the people of our state, not the government,” the governor continued.

Watch the governor's full remarks below.