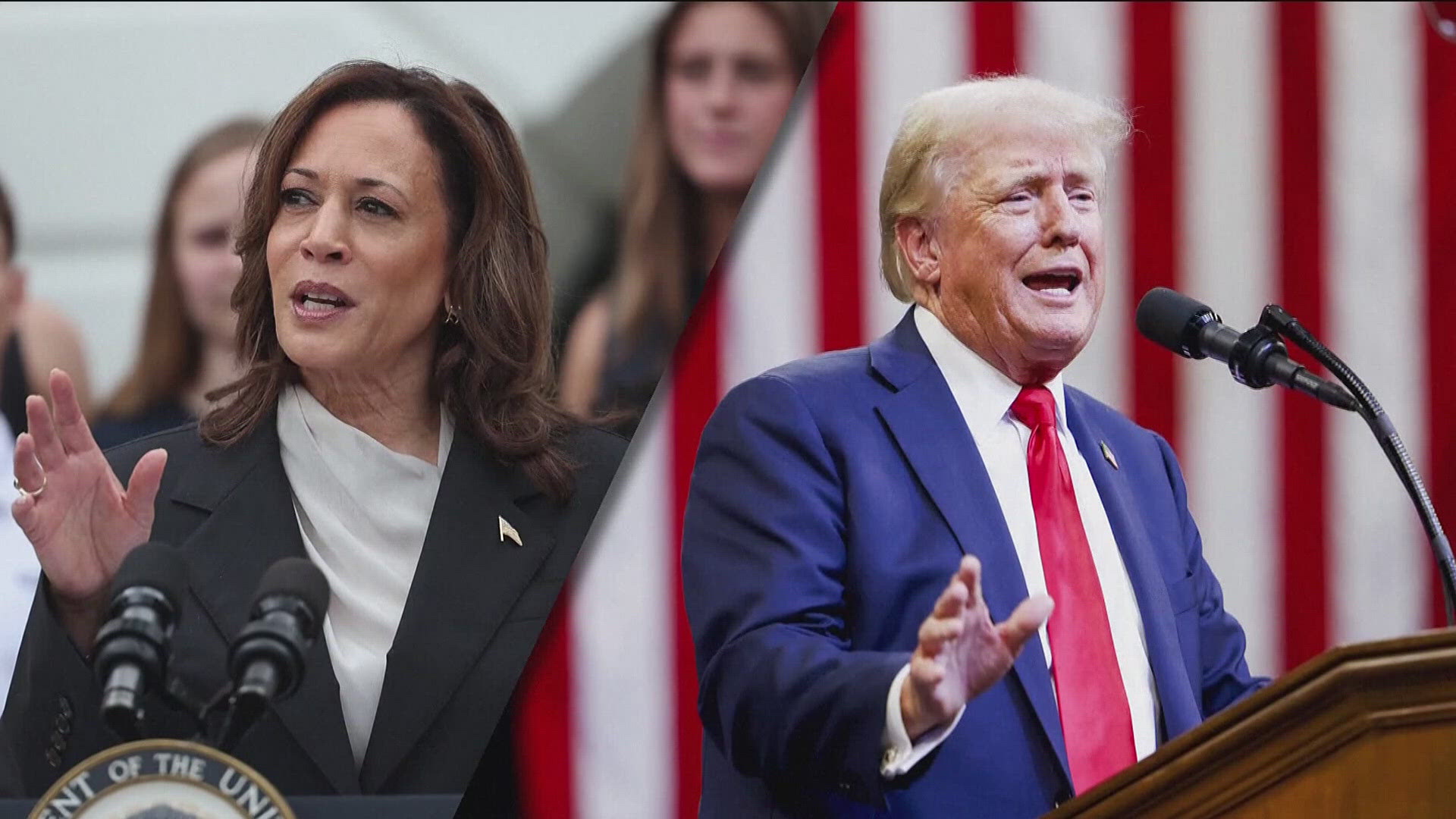

GEORGIA, USA — The political season is kicking into high gear, and the general election is slightly over two months away.

As candidates continue campaigning to win over voters in battleground Georgia, some of you might consider making a donation to support your political party.

What does that mean for your taxes in April 2025?

The Question

Can you write off your political contributions on your taxes?

The Sources

The Answer

No, financially supporting anything meant to influence legislation—including a political party or campaign—is not tax-deductible.

What We Found

Both TurboTax and H&R Block clearly state that political donations, including money given to political parties, campaigns or candidates, are not tax-deductible.

Turbo Tax explained that contributions to political newsletters or paying for dinners or programs that benefit a political party or candidate are not tax-deductible.

It's not just your personal wallet; businesses can't deduct political contributions or donations from their tax returns.

According to H&R Block, charitable contributions made to tax-exempt organizations under 502(c)(3) of the Internal Revenue Code -- are deductible.

The IRS adds that those tax-exempt organizations are particularly barred from trying to influence legislation or participate in any political campaign.