ATLANTA — Something to be aware of this tax season – possible identity theft.

Some people may try to file your tax return using your social security number.

So let's verify, is there a way to check to see if someone else filed your taxes using your social security number?

SOURCES:

Internal Revenue Service (IRS)

WHAT WE FOUND:

In many cases, you won't find out until after the second return is filed. This could either be you trying to file for what you think is the first time or it could be when scammers files after you have.

If the IRS stops a suspicious tax return filing, they might send a letter called "Letter 507IC."

This would ask you to verify your identity either through a phone number or through the IRS' identity verification service.

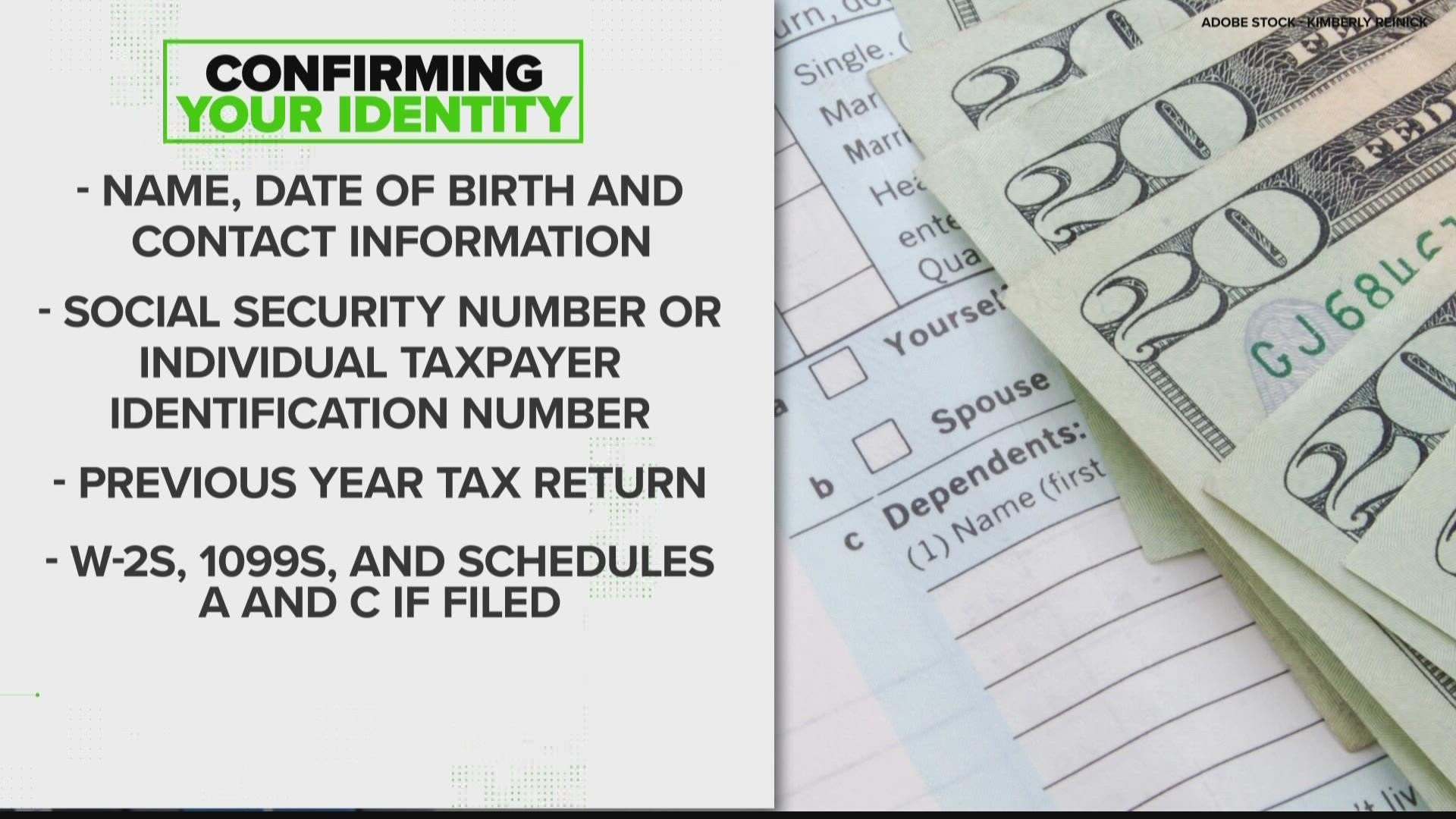

To verify, you'll need your basic personal information as well as the previous year's tax return and supporting documents like your W-2.

If you think this may have happened to you, get a hold of the IRS either online or by phone to start the process to get things straightened out.

You should also call your local police department to file an identity theft affidavit form with the IRS.