ATLANTA — The IRS Criminal Investigation field office in Atlanta on Friday sent out a reminder that, despite it being an almost yearly topic in the state legislature, sports betting is still illegal in Georgia -- and, as the field office, noted, illegal gambling is a criminal offense.

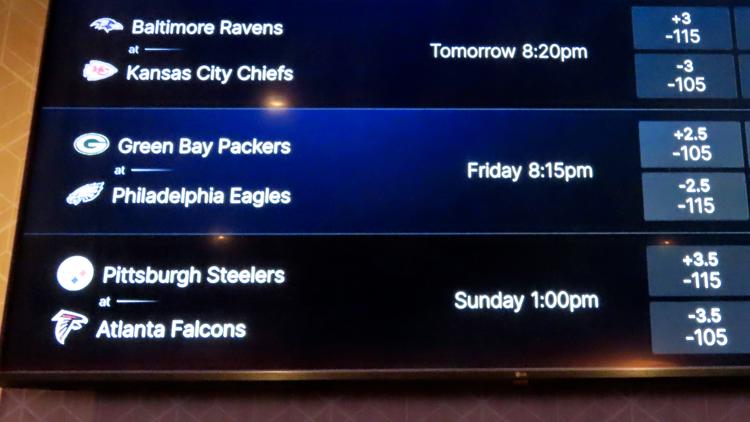

The message was sent as football season has gotten underway in the last couple weeks. The NFL is America's most popular sports league, and it's most-gambled-on, and college football is huge for sports betting as well.

"While many states have authorized sports betting, Alabama and Georgia are among those that do not," an IRS release stated.

South Carolina also has not legalized sports betting. Among Georgia's neighboring states that do have legal sports betting are Tennessee, North Carolina and Florida.

And, yes, if you're using a VPN in a state where sports betting is authorized to use a sports betting app with a masked location, that can also be illegal. Using underground bookies and organized illegal gambling syndicates, which can sometimes include offshore sites, can land sports betters in hot water.

The agency noted that 11 people were indicted in Alabama last year in a "multi-million dollar wagering excise tax evasion scheme involving an illegal sports-betting organization" known as Red44 that took bets via an offshore server located in Costa Rica.

“Individuals who participate in illegal gambling may think it’s a harmless activity that does not affect anyone,” said Special Agent In Charge Demetrius Hardeman, IRS-CI Atlanta Field Office. “However, illegal gambling activities provide criminal organizations money to finance violent and illicit activities.”

The IRS release added some more information on tax obligations for sports gamblers:

Individuals who engage in sports betting activities are required to report their winnings on their annual tax return. Additionally, the IRS encourages individuals to keep detailed records of all gambling transactions, including bets placed, winnings received, and losses incurred.

Sports enthusiasts who are unsure about their tax obligations or have questions about reporting gambling income are encouraged to consult tax professionals or visit the official IRS website for guidance. Ignorance of the tax law does not exempt individuals from their responsibilities.