ATLANTA — The road to stability for Hannah Mizener and her partner, Angela, has had a few stops.

"We just never know where we’re going to be, so we have to probably rent for the rest of our lives," Mizener said. "That’s kind of the common belief we’ve had for a few years. Moving around a lot is exhausting. I think we've moved every year for the past ten years."

Mizener said renting got expensive, but it was difficult for her to find enough space that could allow her to work from home and her dogs to live and play.

"If you're spending so much money on rent, then how much money do I really have to put aside on top of utilities and other bills to save to have enough for a down payment for a house? It seemed impossible," Mizener said. "We might as well be putting money on a mortgage rather than continuing to throw away this rental money."

Right now, the average rent in Atlanta rests around $1,600 according to Realtor.com. Per Zillow, the average home value tops $400,000. As summer heats up, so does Atlanta's housing market. To address a generational issue of home affordability in Atlanta, one local realtor is proposing a solution that's not been seen in the state of Georgia before.

Realtor Michael Crute said the road to home affordability includes a few hurdles, such as overcoming supply shortages and mounting student loan and credit card debt. He said all of these have converged to make the possibility of affording a home that much more difficult to reach. He noted misinformation and misunderstanding have led to many people thinking themselves out of buying a home.

"For some, it's apathy," Crute said. "For some, it's this feeling of despair, like this will never be possible and I'll never be able to do it. We believe it’s our purpose to try and get as many people as possible into homeownership and help them on that journey to start creating wealth.”

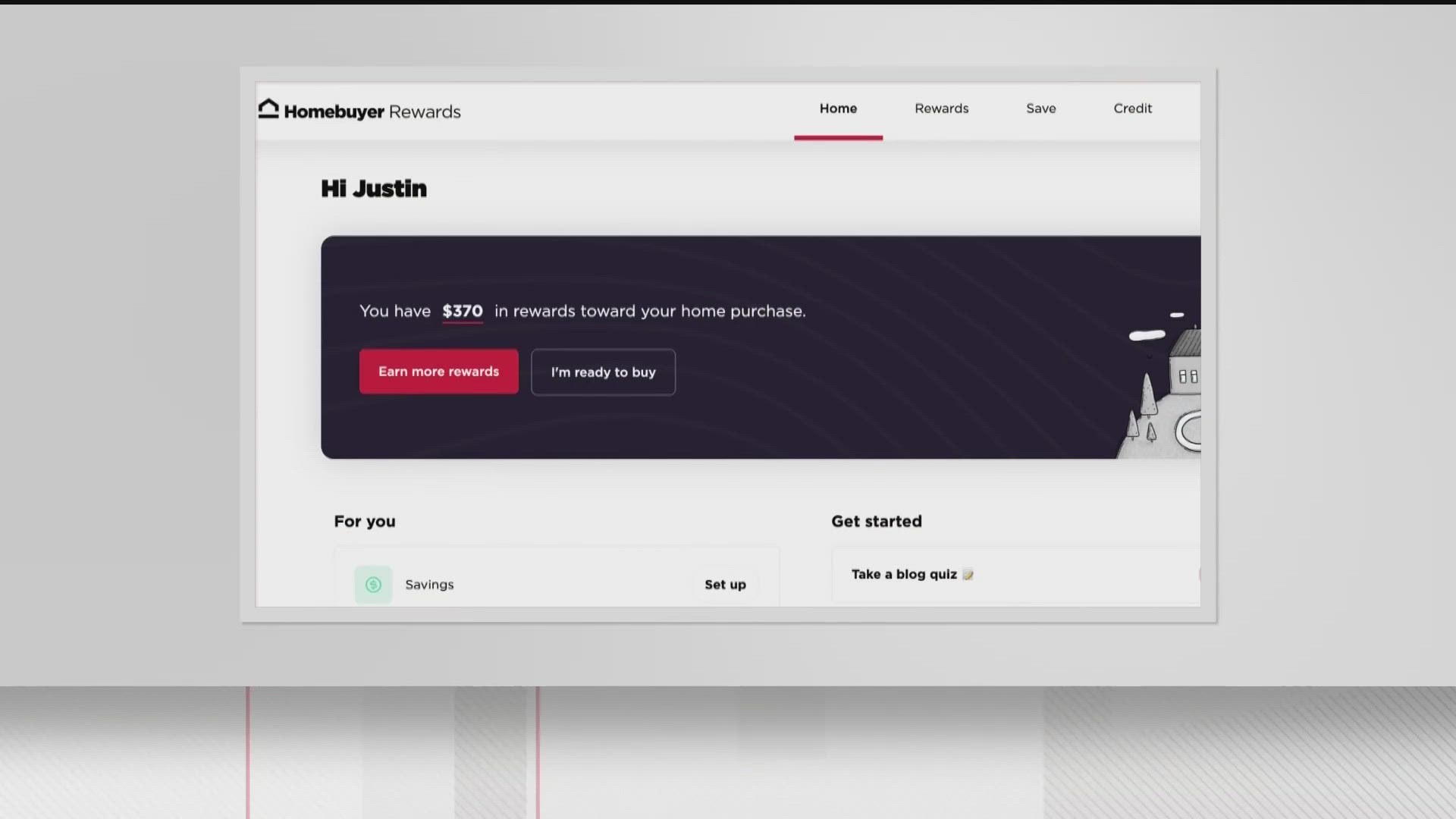

Crute said a new rent rewards program through the real estate agency Welcome Home Atlanta takes 5% of someone's rent and applies it to purchase costs of up to 1% of the home's value. It counts for wherever someone is renting and makes this different from typical rent-to-own programs.

"It doesn't cost our consumers anything else to get involved," Crute said. "They simply sign up, and we start crediting them cashback that can be applied toward their down payment and closing costs simply for doing what they're already doing."

The program launched in April, and has already included 20 prospective homebuyers. Crute said the goal was to take in about 500 people, and as long as one is paying rent, they are eligible.

Crute said the program does take a chunk out of a realtor's commission. However, participants learn about their lender's credit score and other financial tidbits that break down the buying process. Crute said he's willing to part with a few thousand dollars if it means restoring hope.

"We're giving people the ability to reimagine what it looks like to build wealth, leave wealth for their family, to explore a new aspect of their own agency," Crute said. "Not only are we creating more qualified and knowledgeable buyers, but we’re helping to spur on wealth expansion for a class and group of people like Millennials and Gen Z that are kind of getting shut out of this wealth-building opportunity.”

Hannah Mizener's road to stability just got smoother. She found a home in Savannah that she will move into this weekend.

"So we got engaged, bought a house and closed within a month," Mizener said. "This finally feels like a place where we can settle down, save money and start putting stuff toward a mortgage to start building equity."

To learn more about the rent rewards program, click here.